As filed with the Securities and Exchange Commission on September 24, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_______________

Arbe Robotics Ltd.

(Exact Name of Registrant as Specified in Its Charter)

_______________

|

Israel |

7373 |

Not Applicable |

||

|

(State or Other Jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Arbe Robotics Ltd.

HaHashmonaim St. 107

Tel Aviv-Yafo

Israel

Telephone No.: +972-73-7969804, ext. 200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_______________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________

Copies to:

|

Richard I. Anslow, Esq. |

Jon Venick, Esq. |

Shay Dayan, Adv. |

_______________

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and business combination described in the prospectus is completed.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of each Class of Security to be registered |

Amount |

Proposed |

Proposed |

Amount of |

|||||||

|

Ordinary Shares, par value NIS 0.000216(6) |

47,212,314 |

$ |

10.00(2) |

$ |

472,123,140 |

$ |

51,508.63 |

||||

____________

(1) The ordinary shares being registered reflect the Recapitalization, as described in the prospectus. The price per ordinary share reflects the valuation of the ordinary shares in the Business Combination Agreement, as described in the prospectus.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED SEPTEMBER 24, 2021 |

47,212,314 Ordinary Shares

Arbe Robotics Ltd.

NASDAQ trading symbol: ARBE

This prospectus relates to the public offering of an aggregate of 47,212,314 ordinary shares which may be sold from time to time by the Selling Shareholders named in this prospectus after the completion of the merger (the “Merger”) of Autobot MergerSub, Inc., a wholly-owned subsidiary of Arbe (“Merger Sub”), with and into Industrial Tech Acquisitions, Inc. (“ITAC”) pursuant to which ITAC survives the merger as a wholly-owned subsidiary of Arbe, and the holders of ITAC common stock receive the right to receive one Arbe ordinary shares for each share of ITAC common stock held at the effective time of the merger and each holder of ITAC warrants receives the right to receive an Arbe warrant to purchase the same number of Arbe ordinary shares at the same exercise price, which is currently $11.50 per share. It is a condition to the merger that, at the effective time of the Merger, Arbe meets all of the Nasdaq requirements for the initial listing of the Arbe ordinary shares.

The Selling Shareholders may offer, sell or distribute all or a portion of the ordinary shares registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the ordinary shares. We will bear all costs, expenses and fees in connection with the registration of these securities. The Selling Shareholders will bear all commissions and discounts, if any, attributable to their sale of ordinary shares See “Plan of Distribution.”

As of the date of this prospectus, there is no market for our ordinary shares or warrants. Assuming that the Merger is completed and Arbe meets the Nasdaq listing requirement, the Arbe ordinary shares will be traded on Nasdaq under the symbols “ARBE” and “ARBEW,” respectively.

We are a “foreign private issuer,” and an “emerging growth company” each as defined under the federal securities laws, and, as such, we are subject to reduced public company reporting requirements. See the section entitled “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Investing in our ordinary shares involves a high degree of risk. You should purchase our ordinary shares only you can afford to lose your entire investment. See “Risk Factors,” which begins on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2021

|

Page |

||

|

1 |

||

|

2 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

4 |

||

|

Historical Comparative and Pro Forma Combined Per Share Data of ITAC and ARBE |

9 |

|

|

12 |

||

|

13 |

||

|

45 |

||

|

47 |

||

|

48 |

||

|

51 |

||

|

53 |

||

|

54 |

||

|

55 |

||

|

Management’s Discussion and Analysis of Financial Conditions and Results of Operations |

57 |

|

|

Unaudited Pro Forma Condensed Combined Financial Information |

66 |

|

|

Notes To Unaudited Pro Forma Condensed Combined Financial Information |

74 |

|

|

78 |

||

|

96 |

||

|

106 |

||

|

111 |

||

|

115 |

||

|

118 |

||

|

125 |

||

|

129 |

||

|

140 |

||

|

146 |

||

|

147 |

||

|

147 |

||

|

147 |

||

|

F-1 |

i

This prospectus forms part of a registration statement on Form F-1 filed by Arbe with the U.S. Securities and Exchange Commission (the “SEC”).

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the terms “Arbe,” the Company,” “us,” “we” and words of like import refer to Arbe Robotics Ltd., together with its subsidiaries. All references in this prospectus to “ITAC” refer to Industrial Tech Acquisitions, Inc.

In this prospectus, we are assuming that:

• the Merger has been completed on the terms set forth in the proxy statement/prospectus included as part of Arbe’s registration statement on Form F-4, Registration No. 333-257250, a copy of which is available on the SEC’s website, www.sec.gov;

• the $100 million PIPE financing has been completed;

• Arbe meets Nasdaq’s initial listing requirements and that the Arbe ordinary shares and Arbe warrants are trading on Nasdaq under the symbols ARBE and ARBEW, and

• Arbe’s board of directors is composed of the individuals named in the prospectus.

In the event that, for any reason, the Merger is not completed, no ordinary shares will be sold pursuant to this prospectus.

Information in this prospectus relating to the number of outstanding Arbe ordinary shares and per share information, unless otherwise provided, reflect the effect of the Recapitalization of our equity securities in anticipation of the Merger as provided in the Business Combination Agreement, which will result in the present Arbe shareholders holding 48,260,747 shares. Depending upon the exercise of warrants and options and the manner of exercise prior to the Recapitalization, the final number of our outstanding ordinary shares may be different from these numbers; however, the difference will not be material. Assuming no redemption by ITAC stockholders, there would be a total of 67,941,483 Arbe ordinary shares outstanding upon completion of the Merger and the PIPE financing, assuming no redemption.

Pursuant to the Recapitalization, (i) all Arbe Warrants (other than warrants which are not required by their terms to be exercised in connection with the Merger and are not exercised at the election of the holder thereof prior to the consummation of the Recapitalization, (ii) all outstanding Arbe Preferred Shares are converted into Arbe Ordinary Shares in accordance with their terms and Arbe’s Amended and Restated Articles of Association in effect on the date of this prospectus, and (iii) each Arbe ordinary share that is outstanding after the exercise and conversion pursuant to clauses (i) and (ii) will become and be converted into such number of Arbe Ordinary Shares as is determined by multiplying such Arbe Ordinary Share by the Conversion Ratio. The Conversion Ratio means such number Arbe Ordinary Shares as is determined by multiplying (1) one Arbe Ordinary Share by (2) the quotient obtained by dividing (A) the sum of (i) $525,000,000, plus (ii) on a dollar-for-dollar basis equal to the amount, if any, by which the ITAC Transaction Expenses (other than expenses relating to the PIPE Investment) (as defined in the Business Combination Agreement) exceed $7,000,000, by (B) $10.00, and subsequently dividing such quotient by the sum of (x) the number of Arbe Ordinary Shares then outstanding and (y) without duplication, the number of Arbe Ordinary Shares issuable upon the exercise of all then outstanding Arbe warrants and options, and taking such quotient to five decimal places. In this prospectus, the number of Arbe ordinary shares assumes that the ITAC Transaction Expenses do not exceed $7,000,000.

In connection with the Merger, Arbe filed a registration statement on Form F-4 registering under the Securities Act the ordinary shares to be issued to the stockholders of ITAC, the Arbe warrants to be issued to the holders of the ITAC warrants and the ordinary shares issuable upon exercise of the Arbe warrants that are issued to the holders of the ITAC warrants. The ordinary shares issued to the public holders of ITAC common stock are the only publicly traded ordinary shares of Arbe.

Since ITAC is a special purpose acquisition corporation, generally known as a SPAC, in connection with ITAC’s initial public offering, ITAC deposited $10.10 per unit in a trust account. At September 13, 2021, the value of the trust account was approximately $77.0 million. In connection with the Merger, all of the public holders of ITAC common

1

stock have the right to have their shares redeemed for a pro rata portion of the trust account. Under the terms of the trust account, the funds in the trust cannot be used for any purpose other than to pay those ITAC public stockholders who exercise their right to have their ITAC common stock redeemed, except that the interest on the trust account may be used by ITAC to pay its taxes. Any funds in the trust account that are not used to redeem ITAC public stockholders is available to pay the expenses of the merger and for use by the surviving company in the Merger, which is Arbe.

Contemporaneously with the execution of the Business Combination Agreement, ITAC and Arbe entered into subscription agreements with investors who agreed, at the closing of the Merger, to purchase 10,000,000 shares of ITAC common stock, or at Arbe’s election, Arbe ordinary shares, in either case at a purchase price of $10.00 per share, which would generate gross proceeds of $100 million.

In this prospectus, we are assuming that the Merger is completed and the sufficient ITAC public shares remained outstanding to that, on the closing date, Arbe met the Nasdaq initial listing requirements, including those relating to the number of beneficial shareholders, the number of shareholders holding a position of at least $2,500, the value of the public float and the number of publicly traded shares held by the public. Since Nasdaq listing is a condition to closing the Merger, if these conditions are not met, the Merger will not have been closed and this registration statement will be withdrawn.

ITAC was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. ITAC’s efforts to identify a prospective target business were not limited to any particular industry or geographic region. Prior to executing the Business Combination Agreement with Arbe, ITAC’s efforts were limited to organizational activities, completion of its initial public offering and the evaluation of possible business combinations.

FUNCTIONAL AND REPORTING CURRENCY

A substantial portion of Arbe’s activity, including transactions with customers, as well as equity transactions and cash investments, are incurred in U.S. dollars. Arbe’s management believes that the U.S. dollar is the currency of the primary economic environment in which it operates. Thus, the functional and reporting currency for Arbe is the U.S. dollar.

In this prospectus, we present industry data, information and statistics regarding the markets in which Arbe competes as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with Arbe’s own internal estimates, taking into account publicly available information about other industry participants and Arbe’s management’s judgment where information is not publicly available. This information appears in “Summary of the Prospectus,” “Arbe’s Management’s Discussion and Analysis of Financial Condition and Results of Operation,” “Arbe’s Business” and other sections of this prospectus.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Arbe owns or has rights to trademarks, trade names and service marks that it uses in connection with the operation of its business. In addition, Arbe’s names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable “©,” “SM” and “TM” symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

2

In this prospectus:

“Arbe Ordinary Shares” and “ordinary shares” means Arbe’s ordinary shares, with a par value of NIS 0.000216 per share, after giving effect to the Recapitalization.

“Arbe Warrants” mean the warrants that are issued by Arbe to the holders of ITAC Warrants pursuant to the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of March 18, 2021, by and among ITAC, Arbe and Merger Sub, as such agreement has been amended or otherwise modified and may hereafter be amended or modified from time to time in accordance with its terms.

“Closing” means the closing of the Merger.

“Effective Time” means the effective time of the Merger pursuant to the Business Combination Agreement.

“Enhanced Lock-up Restrictions” means the additional restrictions to which the Sponsor is subject pursuant to the Founder Lock-Up Agreement.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Israeli Companies Law” means the Israeli Companies Law, 5759-1999, as amended.

“ITAC” means Industrial Tech Acquisitions, Inc., a Delaware corporation, which, as a result of Merger, becomes a wholly-owned subsidiary of Arbe.

“Merger” means the merger of Merger Sub with and into ITAC, with ITAC surviving the merger and becoming a wholly-owned subsidiary of Arbe, and the holders of ITAC common stock and warrants receiving the right to receive Arbe ordinary shares and warrants the other transactions contemplated by the Business Combination Agreement.

“Nasdaq” means the Nasdaq Stock Market.

“Recapitalization” means the recapitalization of Arbe in anticipation of the Merger and pursuant to the Business Combination Agreement pursuant to which (i) all Arbe Warrants (other than warrants which are not required by their terms to be exercised in connection with the Merger and are not exercised at the election of the holder thereof prior to the consummation of the Recapitalization) will be exercised, (ii) all outstanding Arbe Preferred Shares are converted into Arbe Ordinary Shares in accordance with their terms and Arbe’s Amended and Restated Articles of Association in effect on the date of this prospectus, and (iii) each Arbe ordinary share that is outstanding after the exercise and conversion pursuant to clauses (i) and (ii) will become and be converted into such number of Arbe Ordinary Shares as is determined by multiplying such Arbe Ordinary Share by the Conversion Ratio. The Conversion Ratio means such number Arbe Ordinary Shares as is determined by multiplying (1) one Arbe Ordinary Share by (2) the quotient obtained by dividing (A) the sum of (i) $525,000,000, plus (ii) on a dollar-for-dollar basis equal to the amount, if any, by which the ITAC Transaction Expenses (other than expenses relating to the PIPE Investment) (as defined in the Business Combination Agreement) exceed $7,000,000, by (B) $10.00, and subsequently dividing such quotient by the sum of (x) the number of Arbe Ordinary Shares then outstanding and (y) without duplication, the number of Arbe Ordinary Shares issuable upon the exercise of all then outstanding Arbe warrants and options, and taking such quotient to five decimal places. In this prospectus, the number of Arbe ordinary shares assumes that the ITAC Transaction Expenses do not exceed $7,000,000.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means Industrial Tech Partners, LLC, a Delaware limited liability company.

“U.S. dollar,” “USD,” “US$” and “$” mean the legal currency of the United States.

“U.S. GAAP” means generally accepted accounting principles in the United States.

“U.S.” means the United States of America.

3

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

Our Business

Arbe is a provider of 4D Imaging Radar solutions, and is leading a radar revolution, enabling truly safe driver-assist systems today while paving the way for fully autonomous driving. Arbe is a research and development company in the field of chips for advanced radar systems, which are mainly intended to be used as Advanced Driver Assistance Systems (“ADAS”) adapted for the next generation of autonomous vehicles as well as for non-automotive uses.

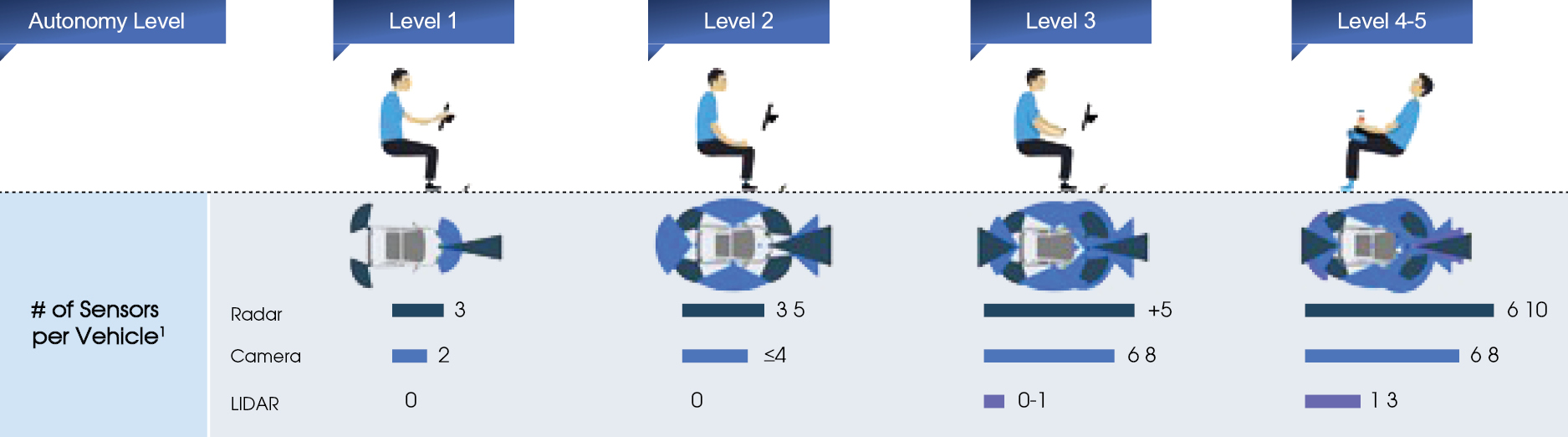

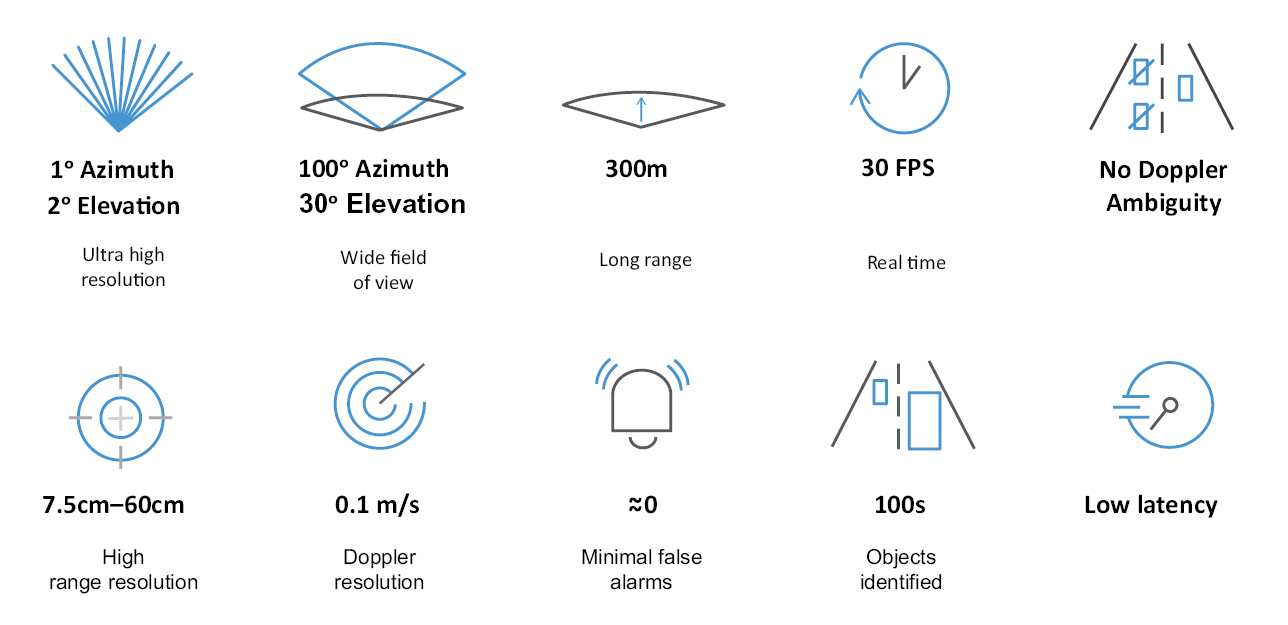

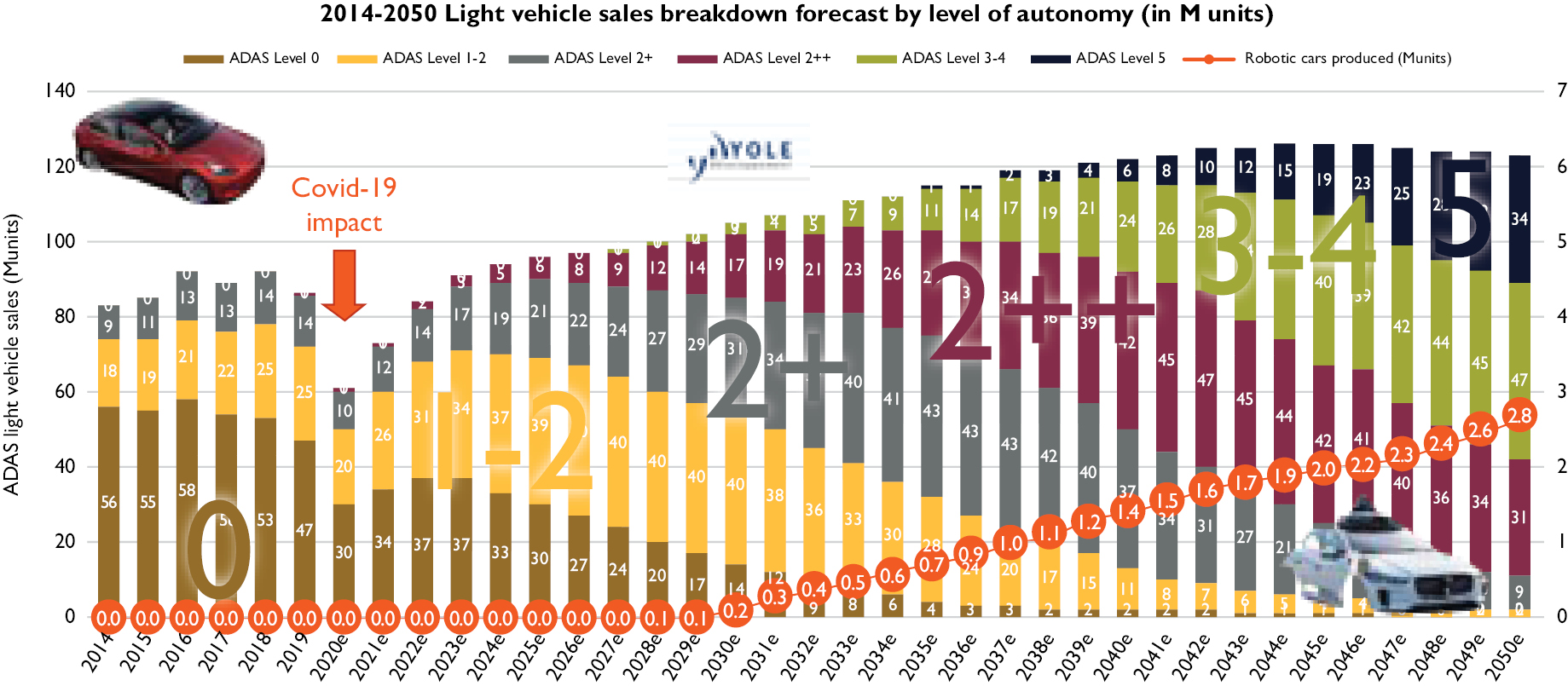

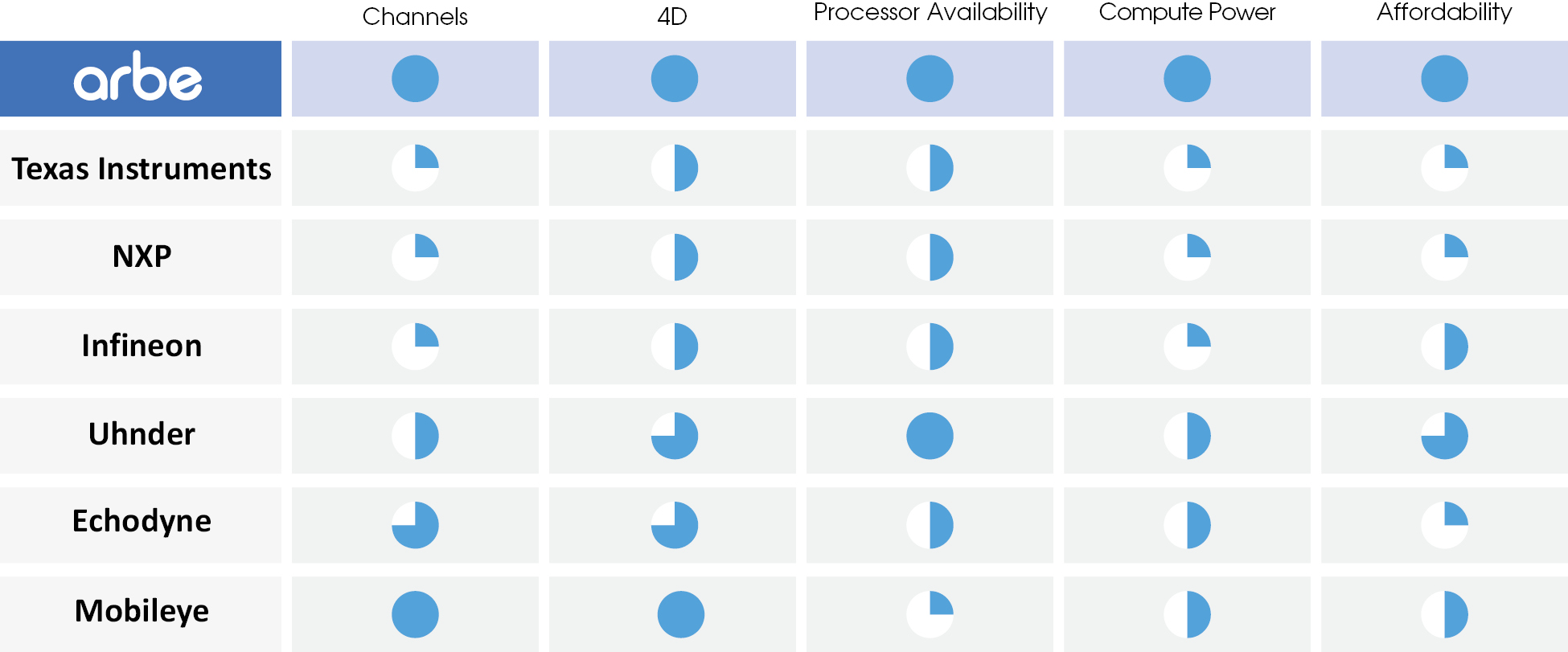

Arbe is empowering automakers, tier-1 companies, and enabling autonomous ground vehicles, commercial and industrial vehicles, and a wide array of safety applications with next-generation sensing and paradigm-changing perception. Arbe’s Imaging Radar offers an order of magnitude higher resolution than any other competing radar solution in the market, and is an essential sensor for L2+ and higher levels of autonomy. Arbe’s solution includes an RF chipset with the largest channel array in the industry, a groundbreaking radar processor chip, and AI-based post-processing. Founded in 2015, Arbe has offices in Israel and the United States.

4D is called 4D because it provides a high-resolution long-range radar sensor that not only detects the distance, relative speed, and an angular measurement of objects but also the height of the object above the road. This capacity can help an autonomous vehicle to decide whether a stationary object up ahead is a manhole cover you can drive over or a guardrail you need to avoid. Arbe’s 4D imaging radar is the world’s first radar to separate, track, and identify objects in any weather or lighting condition in 2K ultra-high resolution in both azimuth and elevation, delivering an image that Arbe believes is 100 time more detailed than any radar on the market. Arbe achieves this capability with its proprietary radio frequency chipset with the highest channel count in the industry, and a groundbreaking radar processor chip, the first dedicated processor designed specifically for the performance and power saving requirements of the automotive industry, and AI-based post-processing.

Arbe’s unique solution addresses the core issues that have caused the recent autonomous vehicle and autopilot accidents such as detecting stationary objects, identifying vulnerable road users, and eliminating false alarms without radar ambiguities. Addressing all driving scenarios and environment corner cases makes Arbe’s solution a critical sensor for vehicles which operate at a Level 2 and higher degree autonomy. Vehicles that are Level 2 are vehicles which includes integrated automation systems, where the driver is still required to control and monitor the environment at all times. The higher the level, the more autonomous the vehicle, with a Level 5 vehicle being fully autonomous with no driver input.

The Business Combination Agreement and PIPE Investment

In anticipation of the Merger, Arbe is effecting the Recapitalization. The number of Arbe Ordinary Shares to be held by the Arbe shareholders after giving effect to the Recapitalization is based on a valuation of $525 million. However, this amount is subject to an increase on a dollar-for-dollar basis to the extent that ITAC’s Transaction Expenses (other than those relating to the PIPE Transaction) exceed $7.0 million.

Pursuant to the Business Combination Agreement, at the Effective Time of the Merger, (i) each outstanding share of ITAC Common Stock, including shares of ITAC Common Stock issued to the PIPE Investors (but excluding any Arbe Ordinary Shares issued to PIPE Investors directly by Arbe), will be converted into the right to receive one newly issued Arbe Ordinary Share, and (ii) each outstanding ITAC Warrant will be converted into the right to receive an equal number of Arbe Warrants for the same exercise price per share and for the same exercise period. Except that the rights of Arbe Ordinary Shares are governed by Israeli law rather than Delaware law, the Arbe Warrants are substantially identical to the ITAC Warrants.

The ordinary shares being sold by Selling Shareholders are being sold following the completion of the Merger, and this prospectus assumes the completion of the Merger. In the event that for any reason the Merger is not completed, no shares will be sold pursuant to this prospectus.

4

Effect of COVID-19

In the first quarter of 2020, the world was hit by the global spread of COVID-19. This dramatic event resulted in macroeconomic consequences. Many countries, including Israel, took significant steps to stem the spread of the virus. These measures included: quarantines, social distancing, restrictions on the movement of citizens, minimizing (and preventing) gatherings and events, restricting transportation of passengers and goods, closing international borders.

The spread of COVID-19 and the actions taken by governments have had a significant impact on the automotive industry, which experienced a dramatic decline in volumes of vehicle production and sales. Some automotive factories were shut down during this period, and new projects planned for the near future were put on hold or cancelled. As a result, some ADAS providers announced following the spread of the pandemic that production would be suspended due to low demand and bottlenecks in the supply chain, alongside their commitment to safeguard the health of employees.

As of the date of this prospectus, many automakers around the world have not yet resumed full operations since the pandemic began. The automotive factories in China are an exception to this pattern, as they were early to return to normal and are currently operating at an accelerated rate.

The extent of the impact of the pandemic on Arbe’s operational and financial performance will depend on various future developments, including the duration and spread of the COVID-19 outbreak and impact on Arbe’s customers, suppliers, contract manufacturers and employees, all of which is uncertain at this time. Arbe believes that the long-term horizon of its business plans can mitigate the impact of the pandemic, but Arbe has taken various measures (such as furloughing employees and adjusting wages) to minimize expenses during this period of reduced activity.

As a result of the pandemic and the steps taken by the Government of Israel to address the pandemic, Arbe reduced its expenses by salary reductions, a hiring freeze and the postponement of the production of its chipsets. The pandemic delayed projects with Tier 1 suppliers and OEMs by an estimated six months. By the end of the third quarter and the beginning of the fourth quarter of 2020, Arbe saw that the automotive industry was starting to become normal, and, based on its indications from the Tier 1 suppliers and OEMs with which Arbe had been working before the pandemic, it ramped up its operations, started hiring and started working toward its full production plan.

Our Organization

We are an Israeli corporation founded on November 4, 2015. The mailing address for our principal executive office is 10 HaHashmonaim St 107, Tel Aviv-Yafo, Israel. Its telephone number is +972-73-7969804, ext. 200. Arbe’s website is https://arberobotics.com/. Information contained on, or that can be accessed through, Arbe’s website or any other website is expressly not incorporated by reference into and is not a part of this prospectus.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

• we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

5

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a quarterly basis as press releases, distributed pursuant to the rules and regulations of the Nasdaq. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

The Nasdaq listing rules provide that a foreign private issuer may follow the practices of its home country, which for us is Israel, rather than the Nasdaq rules as to certain corporate governance requirements, including the requirement that the issuer have a majority of independent directors and the audit committee, compensation committee and nominating and corporate governance committee requirements, the requirement to disclose third party director and nominee compensation and the requirement to distribute annual and interim reports. A foreign private issuer that follows a home country practice in lieu of one or more of the listing rules shall disclose in its annual reports filed with the SEC each requirement that it does not follow and describe the home country practice followed by the issuer in lieu of such requirements. Currently, Arbe does not plan to rely on the home country practice exemption with respect to its corporate governance other than the quorum requirements. The Restated Arbe Articles, which become effective at or about the closing of Merger, provide that two shareholders holding 25% of the voting shares constitutes a quorum, as contrasted with the Nasdaq requirement of one-third of a company’s outstanding voting securities. If Arbe chooses to take advantage of other home country practice in the future, its shareholders may be afforded less protection than they otherwise would enjoy under Nasdaq corporate governance listing standards applicable to U.S. domestic issuers.

Implications of Being an Emerging Growth Company

As a company with less than US$1.07 billion in revenue for the last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards. We intend to take advantage of certain of these exemptions.

We will remain an emerging growth company until the earliest of (i) the last day of our fiscal year during which we have total annual gross revenues of at least US$1.07 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on which we have, during the previous three year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if the market value of our ordinary shares that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

6

The Offering

|

Ordinary Shares Offered: |

The Selling Shareholders are offering 47,212,314 ordinary shares following completion of the Merger(1) |

|

|

Outstanding Ordinary Shares: |

67,941,483 ordinary shares after Recapitalization and completion of the Merger(2) |

|

|

Use of Proceeds: |

Arbe will not receive any proceeds from this offering. |

____________

(1) Represents 46,984,355 outstanding ordinary shares and 227,959 ordinary shares issuable upon exercise of warrants held by one of the selling shareholders.

(2) The number of outstanding ordinary shares is based on the presently outstanding Arbe ordinary shares and is subject to adjustment in the event of option exercises prior to the closing of the Merger, and assume that no ITAC shares are redeemed. To the extent that public shares of ITAC are redeemed in connection with the Merger, the number of outstanding shares will be reduced by the number of public shares redeemed.

Recapitalization

All share and per share information concerning our ordinary shares reflects the Recapitalization which will be effective immediately prior to the completion of the Merger.

7

SUMMARY FINANCIAL INFORMATION

The following statements of operations data for the years ended December 31, 2020 and 2019, balance sheet data as of December 31, 2020 and 2019 and statements of cash flows data for the years ended December 31, 2020 and 2019 have been derived from Arbe’s audited consolidated financial statements included elsewhere in this prospectus, with share and per share information being adjusted to reflect the Recapitalization. You should read this Summary Financial Data section together with Arbe’s financial statements and the related notes and “Arbe’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Dollars in thousands, except per share information.

Statements of Operations Data:

|

Years Ended December 31, |

|||||||

|

2020 |

2019 |

||||||

|

Revenues |

$ |

332 |

|

$ |

— |

||

|

Cost of Revenues |

|

340 |

|

|

— |

||

|

Gross Loss |

|

(8 |

) |

|

— |

||

|

Operating Expenses: |

|

|

|

||||

|

Research and Development |

|

12,794 |

|

|

22,012 |

||

|

Sales and Marketing |

|

1,063 |

|

|

1,933 |

||

|

General and Administrative |

|

1,093 |

|

|

1,187 |

||

|

Total Operating Expenses |

|

14,950 |

|

|

25,132 |

||

|

Operating Loss |

|

14,958 |

|

|

25,132 |

||

|

Financial Expenses, net |

|

667 |

|

|

475 |

||

|

Net Loss |

$ |

15,625 |

|

$ |

25,607 |

||

Balance Sheet Data:

|

December 31, |

||||||||

|

2020 |

2019 |

|||||||

|

Current assets |

$ |

4,021 |

|

$ |

17,422 |

|

||

|

Working capital (deficiency) |

|

(1,250 |

) |

|

11,060 |

|

||

|

Redeemable convertible preferred shares |

|

55,440 |

|

|

53,973 |

|

||

|

Accumulated deficit |

|

(61,554 |

) |

|

(45,929 |

) |

||

|

Shareholders’ deficiency |

|

(60,157 |

) |

|

(45,053 |

) |

||

|

|

|

|

|

|||||

Selected Cash Flows Data:

|

Year ended December 31, |

||||||||

|

2020 |

2019 |

|||||||

|

Net cash used in operations |

$ |

(15,285 |

) |

$ |

(22,559 |

) |

||

|

Net cash provided by (used in) investing activities |

|

9,704 |

|

|

(8,537 |

) |

||

|

Net cash provided by financing activities |

|

1,532 |

|

|

35,545 |

|

||

8

HISTORICAL COMPARATIVE AND PRO FORMA COMBINED

PER SHARE DATA OF ITAC AND ARBE

The following table sets forth summary historical comparative share and unit information for ITAC and Arbe and unaudited pro forma condensed combined per share information of ITAC after giving effect to the Merger (including the Recapitalization), assuming two redemption scenarios as follows:

• Assuming No Redemptions: This presentation assumes that no ITAC stockholders exercise redemption rights with respect to their Public Shares.

• Assuming Maximum Redemptions: This presentation assumes that all ITAC Public Stockholders holding approximately 7,623,600 Public Shares will exercise their redemption rights for the $76,998,360 of funds in ITAC Trust Account. Each of Arbe’s and ITAC’s obligations under the Business Combination Agreement are subject to ITAC or Arbe having (i) at least $100 million (the “Minimum Cash Amount”) and (ii) net tangible assets of at least $5,000,001; upon consummation of the Merger.

The unaudited pro forma book value information reflects the Merger as if it had occurred on December 31, 2020. The weighted average shares outstanding and net earnings per share information reflect the Merger and the Recapitalization as if they had occurred on January 1, 2020.

This information is only a summary and should be read together with the summary historical financial information included elsewhere in this prospectus, and the historical financial statements of ITAC and Arbe and related notes that are included elsewhere in this prospectus. The unaudited pro forma combined per share information of ITAC and Arbe is derived from, and should be read in conjunction with, the unaudited pro forma condensed combined financial statements and related notes included elsewhere in this prospectus.

The unaudited pro forma combined earnings per share information below does not purport to represent the earnings per share which would have occurred had the companies been combined during the periods presented, nor earnings per share for any future date or period and treats the Recapitalization as being effective on January 1, 2020. The unaudited pro forma combined book value per share information below does not purport to represent what the value of ITAC and Arbe would have been had the companies been combined during the periods presented.

|

Combined Pro Forma |

||||||||||||||||

|

ITAC |

Arbe |

Assuming No Redemptions |

Assuming Maximum Redemptions |

|||||||||||||

|

As of and For the Year Ended December 31, 2020(2) |

|

|

|

|

|

|

|

|

||||||||

|

Book value per share(1) |

$ |

1.64 |

|

$ |

(302.3 |

) |

$ |

2.28 |

|

$ |

1.21 |

|

||||

|

Weighted average shares outstanding – basic and diluted |

|

3,047,043 |

|

|

198,997 |

|

|

63,526,200 |

|

|

55,902,600 |

|

||||

|

Net loss per share – basic and diluted |

$ |

(0.74 |

) |

$ |

(78.52 |

) |

$ |

(0.28 |

) |

$ |

(0.31 |

) |

||||

____________

(1) Book value per share equals total equity divided by total shares. The ITAC historical weighted average shares outstanding includes 5,578,881 shares subject to redemption for ITAC at December 31, 2020.

(2) No cash dividends were declared under the periods presented.

Summary of Risk Factors

Arbe’s business is subject to numerous risks described in the section titled “Risk Factors” and elsewhere in this prospectus. The main risks set forth below and others you should consider are discussed more fully in the section entitled “Risk Factors,” which you should read in its entirety.

• Arbe is an early-stage company with a history of losses, and it expects to incur significant expenses and continuing losses for the foreseeable future.

• Arbe’s limited operating history and evolving business model makes evaluating its business and future prospects difficult and may increase the risk of your investment.

9

• Arbe is creating innovative technology by designing and developing unique components. The high price of, or low yield in, these components may affect Arbe’s ability to sell at competitive prices, or may lead to losses.

• Arbe expects to invest substantially in research and development for the purpose of developing and commercializing new products, and these investments could significantly reduce its profitability or increase its losses and may not generate revenue for Arbe.

• If market adoption of Arbe’s products does not develop, or develops more slowly than Arbe expects, its business will be adversely affected.

• Adoption of Arbe’s products for other emerging markets may not occur or may occur more slowly than Arbe anticipates, which would adversely affect Arbe’s business and prospects.

• Agreements with customers may not generate the anticipated revenue as Arbe is subject to the risks of cancellation or postponement of contracts or unsuccessful implementation

• Arbe may not be able to accurately estimate the supply and demand of its products, which could result in a variety of inefficiencies in its business and hinder its ability to generate revenue.

• If market adoption of Arbe’s products does not develop, or develops more slowly than Arbe expects, its business will be adversely affected.

• Arbe targets many customers that are large companies with substantial negotiating power, exacting product standards and potentially competitive internal solutions. If Arbe is unable to sell its products to these customers, its prospects and results of operations will be adversely affected.

• Arbe continues to implement strategic initiatives designed to grow its business. These initiatives may prove more costly than it currently anticipates, and Arbe may not succeed in increasing its revenue in an amount sufficient to offset the costs of these initiatives and to achieve and maintain profitability.

• The markets in which Arbe competes are characterized by rapid technological change, which requires Arbe to continue to develop new products and product innovations, and could adversely affect market adoption of its products.

• Certain of Arbe’s strategic, development and supply arrangements could be terminated or may not materialize into long-term contract partnership arrangements.

• Adoption of Arbe’s products for other emerging markets may not occur or may occur more slowly than Arbe anticipates, which would adversely affect Arbe’s business and prospects.

• The complexity of Arbe’s products could result in unforeseen delays or expenses from undetected defects, errors or bugs in hardware or software which could reduce the market adoption of its new products, damage its reputation with current or prospective customers, expose Arbe to product liability, warranty and other claims and adversely affect its operating costs.

• Arbe operates in a highly competitive market against a large number of both established competitors and new market entrants, and some market participants have substantially greater resources than Arbe.

• Arbe expects its results of operations to fluctuate on a quarterly and annual basis, which could cause the share price of the combined company to fluctuate or decline.

• Arbe’s business depends on its ability to attract and retain highly skilled personnel and senior management. Failure to effectively retain, attract and motivate key employees could diminish the anticipated benefits of the Business Combination.

• Arbe relies on third-party suppliers and, because some of the key components in its products come from limited or sole sources of supply, Arbe is susceptible to supply shortages, including a shortage of semiconductors which is affecting the auto industry in general, long lead times for components and supply changes, any of which could disrupt its supply chain and could delay deliveries of its products to customers.

10

• Arbe may be subject to risks associated with autonomous driving, including, but not limited to, technical malfunctions, regulatory obstacles, and/or product liability.

• Arbe has been, and may in the future be, adversely affected by the global COVID-19 pandemic or another pandemic, the duration and economic, governmental and social impact of which is difficult to predict, which may significantly harm Arbe’s business, prospects, financial condition and operating results.

• The ongoing COVID-19 pandemic may adversely affect ITAC’s and Arbe’s ability to consummate the Transactions as well as Arbe’s business after completion of the Merger.

• Arbe may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its solutions, and Arbe’s efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly.

• Arbe relies on its unpatented proprietary technology, trade secrets, processes and know-how, in addition to patented technology.

• Arbe is subject to, and must remain in compliance with, numerous laws and governmental regulations concerning the manufacturing, use, distribution and sale of its products, as well as requirements of some of its customers.

• Arbe’s business may be adversely affected by changes in automotive safety regulations or concerns that drive further regulation of the automobile safety market.

• As a company organized under the laws of Israel and located in Israel, Arbe will be subject to risks associated with conducting business in Israel, including risks related to political, economic, and military conditions in Israel and the surrounding region.

• Failures, or perceived failures, to comply with privacy, data protection, and information security requirements in the variety of jurisdictions in which Arbe operates may adversely impact its business, and such legal requirements are evolving, uncertain and may require improvements in, or changes to, Arbe’s policies and operations.

11

PRICE RANGE OF SECURITIES AND DIVIDENDS

ITAC

ITAC Units, ITAC Class A Common Stock and ITAC Warrants are currently listed on Nasdaq under the symbols “ITACU,” “ITAC” and “ITACW,” respectively. Each ITAC Unit consists of one share of ITAC Class A Common Stock and one Public Warrant. Each whole ITAC Warrant entitles its holder to purchase one share of ITAC Class A Common Stock at a price of $11.50 per share. ITAC Units commenced trading on Nasdaq on September 9, 2020. ITAC Class A Common Stock and ITAC Warrants commenced trading on Nasdaq on October 30, 2020. In connection with the Merger, the ITAC Units will be separated into the Common Stock and Warrants comprising the Units and the Units will cease trading, and the holders of ITAC common stock will become holders of the same number of Arbe ordinary shares and the holders of ITAC warrants will become holders of Arbe warrants to purchase the same number of Arbe ordinary shares at the same exercise price as the ITAC warrants.

Holders

As of September 13, 2021, ITAC had one holder of record of its units, two holders of record of Class A common stock, one holder of record of Class B common stock and two holders of record of ITAC warrants. ITAC’s management believes ITAC has in more than 1,700 beneficial holders of its securities as of August 31, 2021.

Dividends

ITAC has not paid any dividends to its stockholders.

Arbe

There is no public market for Arbe’s securities. Upon completion of the Merger, and assuming that Arbe meets the Nasdaq initial listing requirement, Arbe’s Ordinary Shares and Arbe Warrants will trade on Nasdaq under the ticker symbols “ARBE” and “ARBEW” respectively, and trading of the ITAC Class A Common Stock and ITAC Warrants will cease and will be delisted from Nasdaq.

Holders

As of the date of this prospectus, (i) Arbe has 30 holders of record of its capital stock and (ii) Arbe has 11 shareholders of record located in the United States who own approximately 18.7% of Arbe’s Ordinary Shares after giving effect to the Recapitalization.

Dividends

Arbe has not paid any dividends to its shareholders. Following the completion of the Merger, Arbe’s board of directors will consider whether or not to institute a dividend policy. Arbe anticipates that it will retain its earnings for use in business operations and, accordingly, does not anticipate that Arbe’s board of directors will declare dividends in the foreseeable future.

12

An investment in our ordinary shares involves significant risks. You should carefully consider all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our ordinary shares. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in Arbe. Additional risks and uncertainties not currently known to Arbe or which Arbe currently deems immaterial may also have a material adverse effect on Arbe’s business, financial condition, results of operations, prospects and/or its share price.

Unless the context otherwise requires, all references in this section to “we,” “us,” or “our” or words of like import refer to Arbe and its subsidiaries.

Risks Related to Arbe’s Business and Industry

Arbe is an early stage company with a history of losses, and expects to incur significant expenses and continuing losses for the foreseeable future.

Arbe incurred a net loss of approximately $15.6 million on revenues of approximately $332,000 for the year ended December 31, 2020. No assurance can be made that Arbe can or will become profitable. Until such time as Arbe begins material commercial deliveries products, it is likely to continue to generate losses. Even if Arbe is able to begin making material commercial deliveries of its products, there can be no assurance that they will be commercially successful.

Arbe expects that losses will continue in the future, and losses may be significantly higher (and may be significantly higher) as Arbe:

• expands its production capabilities or outsources such production;

• expands its design, development, installation and servicing capabilities;

• increase its research and development;

• produces an inventory; and

• increases its sales and marketing activities and develops its distribution infrastructure.

Arbe will incur the expenses from these efforts before it receives sufficient revenues to cover its incremental revenues with respect thereto, and therefore Arbe’s losses in future periods may be significant. In addition, Arbe may find that these efforts are more expensive than it currently anticipates or that these efforts may not result in revenues, which would further increase Arbe’s losses.

The report of Arbe’s independent registered public accounting firm expresses substantial doubt about its ability to continue as a going concern.

Arbe’s auditor, Somekh Chaikin, Member Firm of KPMG International, has indicated in its report on Arbe’s financial statements for the fiscal year ended December 31, 2020 that Arbe has suffered recurring losses from operations and has a negative cash flow from operating activities that raise substantial doubt about its ability to continue as a going concern. A “going concern” qualification could impair Arbe’s ability to finance its operations through the sale of equity, to incur debt, or to pursue other financing alternatives. Arbe believes that upon completion of the Merger, including the PIPE financing, the auditors will be able to remove the going concern qualification.

13

Arbe’s limited operating history and evolving business model makes evaluating its business and future prospects difficult and may increase the risk of your investment.

Arbe has been focused primarily on developing 4D imaging radar technology products since 2017, and has not generated any revenue until 2020. This relatively limited operating history and modest level of revenue to date makes it difficult to evaluate Arbe’s future prospects and the risks and challenges it may encounter. Further, because Arbe has limited historical financial data and operates in a rapidly evolving market, any predictions about its future revenue and expenses may not be as accurate as they would be if it had a longer operating history or operated in a more predictable market.

In addition, following the closing of the Merger, Arbe’s management may decide to make changes to Arbe’s business model in response to shifts or perceived shifts in market sentiment or otherwise and it may incorrectly gauge the direction of the market. In this connection, Arbe’s business and operations may undergo changes that result is a material change in its business and the direction of its business. Any such modifications could result in increased losses (as pivoting the business may be costly) and future results may differ materially from those that were presented to the ITAC Board of Directors or otherwise presented herein. Any change in Arbe’s business model may make the results of its operations to date less useful in evaluating Arbe’s business and prospects.

If Arbe fails to address the risks and difficulties that it faces, including those described elsewhere in this “Risk Factors” section, its business, financial condition and results of operations could be impaired. Arbe has encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. If Arbe’s assumptions regarding these risks and uncertainties, which it uses to plan and operate its business, are incorrect or change, or if it does not address these risks successfully, its results of operations could differ materially from its expectations and its business, financial condition and results of operations could be adversely affected.

Because Arbe is creating innovative technology by designing and developing unique components, the high price of or low yield in these components may affect Arbe’s ability to sell at competitive prices, and may lead to losses.

Part of Arbe’s technological approach to providing cost-effective and high-performance products involves using a multi-disciplinary approach to design some of its components. Many of these components are complex and contain multiple sophisticated elements with various workstreams involved therein. Such elements may require extreme precision and present challenges to bring products to market in an efficient and profitable manner. This can lead to increased costs of production or a decrease in the production yield as compared to what is currently contemplated or projected. Any such change could significantly increase Arbe’s production costs and thereby decrease its margins and potentially increase or cause losses for Arbe.

Arbe expects to invest substantially in research and development for the purpose of developing and commercializing new products, and these investments could significantly reduce its profitability or increase its losses and may not generate revenue for Arbe.

Arbe’s future growth depends on maintaining its technological leadership in order to introduce new products that achieve market acceptance and penetrate new markets. Therefore Arbe currently plans to incur substantial research and development costs as part of its efforts to design, develop, manufacture and commercialize new products and enhance existing products. Arbe’s research and development expenses were approximately $12.8 million during 2020 and approximately $22.0 million for 2019. The decrease in research and development expenses in 2020 reflected the staff reductions and a hiring freeze following steps taken by Arbe to address the COVID-19 pandemic and the effect of the pandemic on the automotive industry in general. In addition, in 2019, Arbe had significant subcontractor costs involved in the development of its processor chip, which costs it did not have in 2020. Arbe expects that its research and development expenses are likely to grow in the future and it seeks to develop its products to meet the anticipated market need. Because Arbe expenses its research and development activities, as it increases these expenses will adversely affect Arbe’s future results of operations. In addition, Arbe’s research and development program may not produce successful results, and even if it does successfully produce new products, those products may not achieve market acceptance, create additional revenue or become profitable. Because the market for Arbe’s products is both leading edge technology and an evolving industry, Arbe can only be successful if it can offer leading edge technology. The failure of Arbe to offer leading edge technology can materially impair its ability to operate profitably.

14

Agreements with customers may not generate the anticipated revenue as Arbe is subject to the risks of cancellation or postponement of contracts or unsuccessful implementation.

Prospective customers of Arbe’s products generally must make significant commitments of resources to test and validate Arbe’s products and confirm that they can integrate with Arbe’s products with other technologies before including Arbe’s products in any particular system, product or model. The development cycles of Arbe’s products with new customers varies widely depending on the application, market, customer and the complexity of the product. In the automotive market, for example, this development cycle can be over several years. As a result of these lengthy development cycles, Arbe spends significant time and resources to have its products selected by potential customers for a particular use. If Arbe fails to secure such relationships, it may not have an opportunity to supply its products within a sector with such a long lead time for a period of several years. Further, Arbe is subject to the risk that customers that order products, which are subject to the customer’s ability to integrate the product with its other systems, may or postpone orders if the customer is not satisfied that Arbe’s product and service meet the customer’s requirements. One customer has a cancellation right on part of its order. If any of the aforementioned or other events were to occur, Arbe’s business, results of operations and financial condition will be impaired.

Arbe may need to raise additional funds in the future in order to execute its business plan and these funds may not be available to Arbe when it needs them. If Arbe cannot raise additional funds when it needs them, its business, prospects, financial condition and operating results could be negatively affected.

Arbe may require capital in addition to the funds available as a result of the Merger in order to fund its growth strategy or to respond to technological advancements, competitive dynamics or technologies, customer demands, business opportunities, challenges, acquisitions or unforeseen circumstances, and it may seek to raise such funding through equity or debt financing.

Arbe may not be able to timely secure such debt or equity financing on favorable terms, or at all. If Arbe raises additional funds through the issuance of equity or convertible debt or other equity-linked securities, shareholders following the closing of the Merger could experience significant dilution. In addition, any debt financing obtained by Arbe in the future, whether in the form of a credit facility or otherwise, could involve restrictive covenants relating to its capital raising activities and other financial and operational matters, which may make it more difficult for Arbe to obtain additional capital and to pursue business opportunities, including potential acquisitions. If Arbe is unable to obtain adequate financing or financing on terms satisfactory to Arbe when Arbe requires it, Arbe’s ability to continue to grow or support its business and to respond to business challenges could be significantly limited. In addition, because Arbe’s decision to issue debt or equity in the future will depend on market conditions and other factors beyond its control, it cannot predict or estimate the amount, timing, nature or success of its future capital raising efforts.

If market adoption of Arbe’s products does not continue to develop, or develops more slowly than Arbe expects, its business will be adversely affected.

While Arbe’s products can be applied for uses in different markets, many of Arbe’s products are still relatively new in the market and it is possible that other technologies and devices, based on new or existing technology or a combination of technologies, will achieve acceptance or leadership as compared to Arbe’s existing or future product lines. Even if Arbe’s products are used from and after the closing of the Merger, Arbe cannot guarantee that its products will be designed into or included in subsequent generations of such commercialized technology. In addition, Arbe expects that widescale use of its products may lag behind these initial applications significantly. The speed of market growth for Arbe’s products is difficult if not impossible to predict, and it is more difficult to predict this market’s future growth in light of the current economic consequences of the COVID-19 pandemic. In addition, to the extent that a market for Arbe’s products develops successfully, Arbe expects that there will be increasing competition from alternative providers and other modalities. If Arbe is not successful in commercialization its products in a timely manner, or not as successful as Arbe expects, or if other modalities gain acceptance by potential customers of Arbe, regulators and safety organizations or other market participants, Arbe’s business, results of operations and financial condition will be materially and adversely affected.

15

Arbe may not be able to accurately estimate the supply and demand of its products, which could result in a variety of inefficiencies in its business and hinder its ability to generate revenue. If Arbe fails to accurately predict its manufacturing requirements, it could incur additional costs or experience delays.

It is difficult to predict Arbe’s future revenues and appropriately budget for its expenses, and Arbe may have limited insight into trends that may emerge and affect its business. Arbe expects that it will be required to provide forecasts of its demand to its potential suppliers several months prior to the scheduled delivery of products to its prospective customers. Currently, there is little historical basis for making judgments on the demand for Arbe’s products or its ability to develop, produce, and deliver products, or Arbe’s profitability in the future. If Arbe overestimates its requirements, its potential suppliers may have excess inventory, which indirectly would increase Arbe’s costs. If Arbe underestimates its requirements, its potential suppliers may have inadequate inventory, which could interrupt manufacturing of its products and result in delays in shipments, which is likely to affect revenue an customer relations. In addition, lead times for materials and components that Arbe’s potential suppliers order may vary significantly and depend on factors such as the specific supplier, contract terms and demand for each component at a given time. If Arbe fails to order sufficient quantities of product components in a timely manner, the delivery of products to its potential customer base could be delayed, which would harm Arbe’s business, financial condition and operating results.

Arbe targets many customers that are large companies with substantial negotiating power, exacting product standards and potentially competitive internal solutions. If Arbe is unable to sell its products to these customers, its prospects and results of operations will be adversely affected.

Many of Arbe’s customers and potential customers are large, multinational companies with substantial negotiating power relative to Arbe and, in some instances, may have internal solutions that are competitive to Arbe’s products. These large, multinational companies also have significant resources, which may allow them to acquire or develop competitive technologies either independently or in partnership with others. Accordingly, even after investing significant resources to develop a product, Arbe may not secure a design win or may not be able to commercialize a product on profitable terms. If Arbe’s products are not selected by these large companies or if these companies develop or acquire competitive technology or negotiate terms that are disadvantageous to Arbe, it will have an adverse effect on Arbe’s business.

Arbe continues to implement strategic initiatives designed to grow its business. These initiatives may prove more costly than it currently anticipates, and Arbe may not succeed in increasing its revenue in an amount sufficient to offset the costs of these initiatives and to achieve and maintain profitability.

Arbe continues to make investments and implement initiatives designed to grow its business, including:

• investing in research and development;

• expanding its sales and marketing efforts to attract new customers in new industries;

• investing in new applications and markets for its products;

• further enhancing its manufacturing processes and partnerships; and

• investing in legal, accounting, and other administrative functions necessary to support its operations as a public company.

These initiatives may prove more expensive than it currently anticipates, and Arbe may not succeed in increasing its revenue, if at all, in an amount sufficient to offset these higher expenses and to achieve and maintain profitability. The market opportunities Arbe is pursuing are at an early stage of development, and it may be many years before the end markets Arbe expects to serve generate significant demand for its products at scale, if at all.

In addition, Arbe’s revenue may be adversely affected for a number of reasons, including the development and/or market acceptance of new technology that competes with Arbe’s products, changes by other market participants with respect to their acceptance or implementation of Arbe’s technology, failure of Arbe’s customers to commercialize autonomous systems that include Arbe’s products, Arbe’s inability to effectively manage its inventory or manufacture products at scale, Arbe’s failure to enter new markets or to attract new customers or expand orders from existing

16

customers or due to increasing competition. Furthermore, it is difficult to predict the size and growth rate of Arbe’s target markets, customer demand for its products, commercialization timelines, developments in autonomous sensing and related technology, the entry of competitive products, or the success of existing competitive products and services. Accordingly, Arbe does not expect to achieve profitability over the near term. If Arbe’s revenue does not grow over the long term, its ability to achieve and maintain profitability may be adversely affected, and the value of its business may significantly decrease.

The markets in which Arbe competes are characterized by rapid technological change, which requires Arbe to continue to develop new products and product innovations, and could adversely affect market adoption of its products.

While Arbe intends to invest substantial amounts on research and development, continuing technological changes in its technology and competitive technologies could adversely affect adoption of Arbe’s products. Arbe’s future success will depend upon its ability to develop and introduce a variety of new capabilities and innovations to its existing product offerings, as well as to introduce a variety of new product offerings to address the changing needs of the markets in which Arbe offers its products. Delays in delivering new products that meet customer requirements could damage Arbe’s relationships with customers and lead them to seek alternative sources of supply.

If Arbe is unable to develop products or system configurations that meet customer requirements, including pricing, on a timely basis or that remain competitive with other technological alternatives, its products could lose market share, its revenue will decline, it may experience operating losses and its business and prospects will be adversely affected.

Certain of Arbe’s strategic, development and supply arrangements could be terminated or may not materialize into long-term contracts.

Arbe has arrangements with strategic, development and supply arrangements with other companies for the development of products or for the incorporation of Arbe’s products in a customer’s products. Some of these arrangements are evidenced by memorandums of understandings and early stage agreements that are used for design and development purposes but that will require renegotiation at later stages of development or replacement by production or master agreements that have yet to be implemented under separately negotiated statements of work, each of which could be terminated or may not materialize into next-stage contracts or long-term contract arrangements. If these arrangements are terminated or if Arbe is unable to enter into next-stage contracts or long-term operational contracts, its business, prospects, financial condition and operating results may be materially adversely affected.

Arbe will be subject to risks associated with strategic alliances.

If Arbe is successful in entering into definitive agreements with potential suppliers or for potential strategic alliances the resulting arrangements will subject Arbe to a number of risks, including risks associated with non-performance by the third party and sharing proprietary information, any of which may materially and adversely affect Arbe’s business and prospects. Arbe’s limited ability to monitor or control the actions of these third parties and, to the extent any of these strategic third parties suffers negative publicity or harm to their reputation from events relating to their business, Arbe may also suffer negative publicity or harm to its reputation by virtue of its association with any such third party. In addition, a third party may have different priorities than Arbe with the effect that the supplier may not give Arbe’s products the priority which Arbe considers important, which could impair our ability to generate revenue.

Arbe may experience difficulties in managing its growth and expanding its operations.

Arbe expects to experience significant growth in the scope and nature of its operations. Arbe’s ability to manage its operations and future growth will require Arbe to continue to improve its operational, financial and management controls, compliance programs and reporting systems. Arbe is currently in the process of strengthening its compliance programs, including its compliance programs related to export controls, privacy and cybersecurity and anti-corruption and financial controls. Arbe may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing controls, programs, systems and procedures, which could have an adverse effect on its business, reputation and financial results.

17

Continued pricing pressures may result in lower than anticipated margins or losses, which may adversely affect Arbe’s business.

Cost-cutting initiatives adopted by Arbe’s customers as well as the effects of competition may result in increased downward pressure on pricing. Arbe expects that as its industry develops and competition grows, its agreements with existing customers may require step-downs in pricing over the term of the agreements or, if commercialized, over the periods of production, and Arbe may not be able to negotiate price reductions from its suppliers. In addition, Arbe’s existing or future customers may reserve the right to terminate their supply contracts for convenience, which enhances their ability to obtain price reductions. Certain large customers may possess significant leverage over their suppliers, including Arbe, because the market is highly competitive. Accordingly, Arbe expects to be subject to substantial continuing pressure from its existing and prospective customers to reduce the price of its products. It is possible that pricing pressures beyond Arbe’s expectations could intensify as automotive OEMs pursue restructuring, consolidation and cost-cutting initiatives. If Arbe is unable to generate sufficient production cost savings in the future to offset price reductions, its gross margin and profitability would be adversely affected.

Adverse conditions within Arbe’s industry or the global economy more generally could have adverse effects on Arbe’s results of operations.

Arbe’s business is directly affected by and significantly dependent on business cycles and other factors affecting the global automobile industry and global economy generally. Production and sales within Arbe’s industry are cyclical and depend on general economic conditions and other factors, including consumer spending and preferences, changes in interest rates and credit availability, consumer confidence, fuel costs, fuel availability, environmental impact, governmental incentives and regulatory requirements and political volatility. In addition, production and sales can be affected by Arbe’s customers’ ability to continue operating in response to challenging economic conditions and in response to regulatory requirements and other factors. Any significant adverse change in any of these factors may result in a reduction in automotive sales and production by Arbe’s customers and could have a material adverse effect on its business, results of operations and financial condition.

Use of Arbe’s products for markets other than the automotive market may not develop or may develop much more slowly than Arbe anticipates, which would adversely affect Arbe’s business and prospects.

Arbe is investing in and pursuing market opportunities in various new sectors and industries. Arbe believes that its ability to increase its revenue will depend in part on its ability to identify potential new markets and develop products and implements a marketing plan aimed at these new markets as they emerge. Each new market presents distinct risks and, in many cases, requires Arbe to address the particular requirements of that market.