Exhibit 99.2

v v v Radar Revolution. Delivered. Arbe’s Q4 & FY 2021 Earnings March 2022

v v v D isclaimer This presentation contains certain “forward - looking statements” within the meaning of the Securities Act of 1933 and the Securit ies Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. The words “expect,” “believe,” “estimate,” “intend,” “plan,” “anticipate,” “ma y,” “should,” “strategy,” “future,” “will,” “project, ” “potential” and similar expressions indicate forward - looking statements. Forward - looking statements are predictions, projections and other state ments about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. The financial results described in this press release are based on Arbe’s preliminary financial statements, which are subject to audit by the Company’s independent accounting firm and are subject to any adjustments result ing from the completion of such audit. These risks and uncertainties include, but are not limited to: ( i ) unanticipated delays or difficulties in connection with the evaluation of Arbe's products in evaluation and test programs; (ii ) the success of road pilot programs for Arbe's products, (iii) Arbe's ability to develop significant revenue as a result of the test progr ams involving its radar system and from customers who purchased Imaging Radar samples; (iv) Arbe's ability to leverage its existing relationships and secure test programs and orde rs resulting from the test programs; (v) Arbe's ability to meet its projected revenue level and its ability to operate profitably; (vi) Arbe’s ability to meet is timetable for full pro duc tion; (vii) Arbe's expectation that it will be engaging with Tier 1 suppliers and OEMs which would be building the radars based on its Chipset solution, eliminating expenses associated with sys tem completion, requirement for undertaking significant capital expenditures associated with developing mass production manufacturing and the expenses of operating any such manufact uri ng capability; (viii) the effect of inflation and supply chain issues on Arbe’s cost and its development schedule, including Arbe's ability to obtain semiconductor products wh en needed and at a reasonable price; (ix) Arbe's expectation that radars are crucial to the automotive industry and will be deployed in nearly all new vehicles as a long rang e, cost - effective sensor with the fewest environmental limitations; (x) Arbe's belief that the Arbe Radar Chipset heralds a breakthrough in radar technology that will enable Tier 1 ma nufacturers and OEMs to replace the current radars with an advanced solution that meets the safety requirements of Euro - NCAP and NHTSA for autonomous vehicles at all levels of autonomo us driving; (xi) Arbe's ability to develop or have access to the latest developments relating to radar and autonomous driving vehicles; (xii) Arbe's ability to have products ma nuf actured for it by third parties that meet Arbe's and its customers quality standards and delivery requirements; (xiii) Arbe's ability to attract and retain highly skilled personnel a nd senior management, including research and development, sales and marketing personnel; (xiv) Arbe's ability to develop and market products based on its radar technology for uses out sid e of the automotive industry; (xv) accidents or bad press resulting from accidents involving autonomous driving vehicles, even those using radar products from other companies or ba sed on other technology; and the effect of any accidents with vehicles using Arbe's radar system; (xvi) the failure of the markets for Arbe's current or new technologies an d p roducts to materialize to the extent or at the rate that Arbe expects; (xvii) unexpected delays or difficulties related to the development of Arbe's technologies and products; (xviii ) t he effect of laws and changes in laws that have an effect on the market for or the requirement for autonomous vehicles; (xix) the effect of COVID - 19 and any new variants or any pandemics or multinational epidemics and actions taken by governments and industry to address the effects of the pandemic and the corresponding macroeconomic uncertainty; (xvii) risks re lated to the potential impact of new accounting standards on Arbe's financial position, results of operations or cash flows; (xx) changes or inaccuracies in market projectio ns; (xxi) changes in Arbe's business strategy; and (xxii) the risk and uncertainties described in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Cautionary Note Regarding Forward - Looking Statements” and the additional risk described in Arbe’s prospectus dated November 2, 2021, which was filed by Arbe wi th the Securities and Exchange Commission on November 4, 2021, as well as the other documents filed by Arbe with the SEC. Accordingly, you are cautioned not to place undue reliance on these forward - looking statements. Forward - looking statements relate only to the date they were made, and Arbe does not undertake any obligation to update forward - looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation. 2

v v v Arbe is the first company to develop an imaging radar based on a proprietary chipset Offering the best performance in the industry, enabling free space mapping for truly safe Level 2.5 - Level 5

v v v 4 Strategic Relationships with Global Tier 1 s and Auto / Industrial OEMs $2.8B in 2025E 30 In 2025 $312M Projected Revenue Projected Order Book $11B in 2025E Projected Automotive Radar TAM Founded in 2015 team members 130 R&D ʫʣʘ Nasdaq listed ARBE World ’ s First Perception radar algorithms Paving the way for an autonomous future Proprietary chipset Ultra high resolution radar solution About Arbe: First Mover & Market Leader in 4D Imaging Radar Arbe Today Mission: From safe roads to autonomous driving

v v v The Market 5 OEMs • 2025 and up • Level 2.5 / Level 3 • High volume • Innovation and safety Trucks • 2023 and up • Level 2.5 / Level 3 • Low volume • Safety and efficiency Delivery robots • 2023 and up • Level 4 • Mid volume • Efficiency RoboTaxi • 2024 and up • Level 4 • Low volume • Not clear

v v v Perception Imaging Radar A Radar of Firsts 6 First to accomplish Free Space Mapping and object tracking in all corner cases First to achieve Simultaneous Location and Mapping (SLAM) First to eliminate false alarms from phantom objects First to leverage velocity & turn rate data to sense what the vehicle will encounter down the road

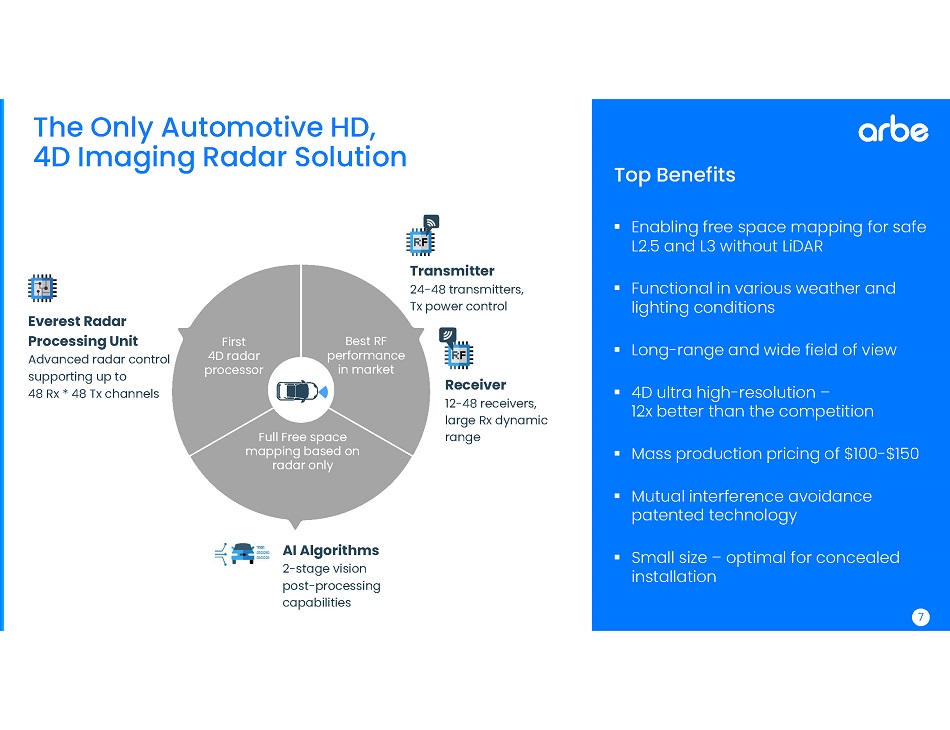

v v v The Only Automotive HD, 4 D Imaging Radar Solution ▪ Enabling free space mapping for safe L 2.5 and L 3 without LiDAR ▪ Functional in various weather and lighting conditions ▪ Long - range and wide field of view ▪ 4 D ultra high - resolution – 12 x better than the competition ▪ Mass production pricing of $ 100 - $ 150 ▪ Mutual interference avoidance patented technology ▪ Small size – optimal for concealed installation Top Benefits AI Algorithms 2 - stage vision post - processing capabilities Transmitter 24 - 48 transmitters, Tx power control Receiver 12 - 48 receivers, large Rx dynamic range Everest Radar Processing Unit Advanced radar control supporting up to 48 Rx * 48 Tx channels Best RF performance in market First 4 D radar processor Full Free space mapping based on radar only 7 7

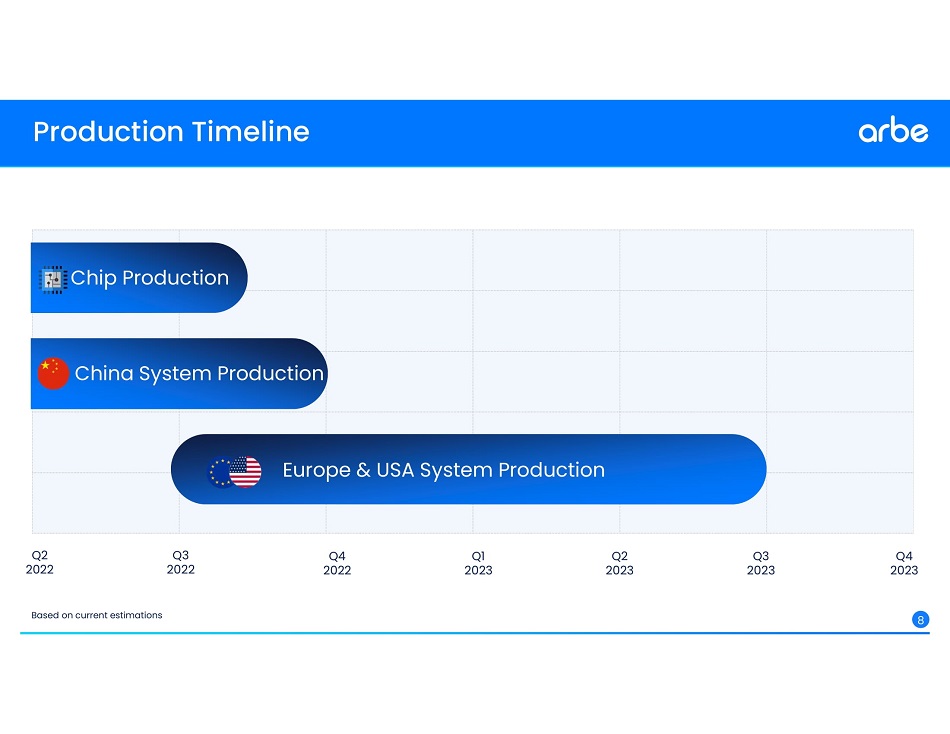

v v v Production Timeline Q 4 2022 Q 1 2023 Q 2 2023 Q 3 2023 Q 4 2023 Chip Production China System Production Europe & USA System Production 8 Q ʥ 2022 Q ʦ 202 ʥ Based on current estimations

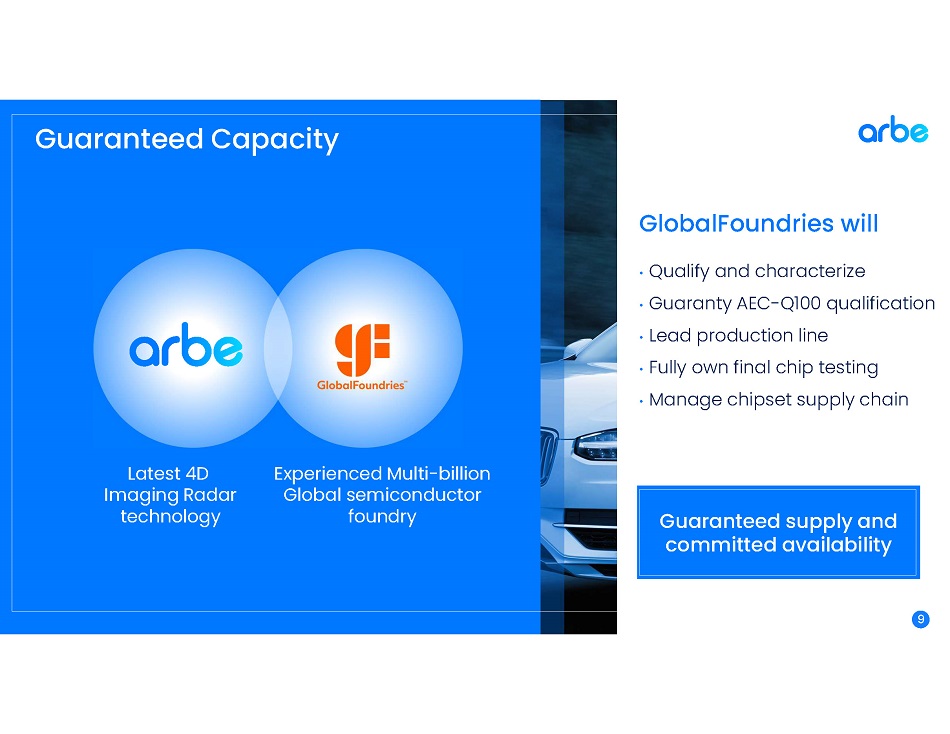

v v v Latest 4 D Imaging Radar technology Experienced Multi - billion Global semiconductor foundry Guaranteed Capacity • Qualify and characterize • Guaranty AEC - Q 100 qualification • Lead production line • Fully own final chip testing • Manage chipset supply chain GlobalFoundries will Guaranteed supply and committed availability 9

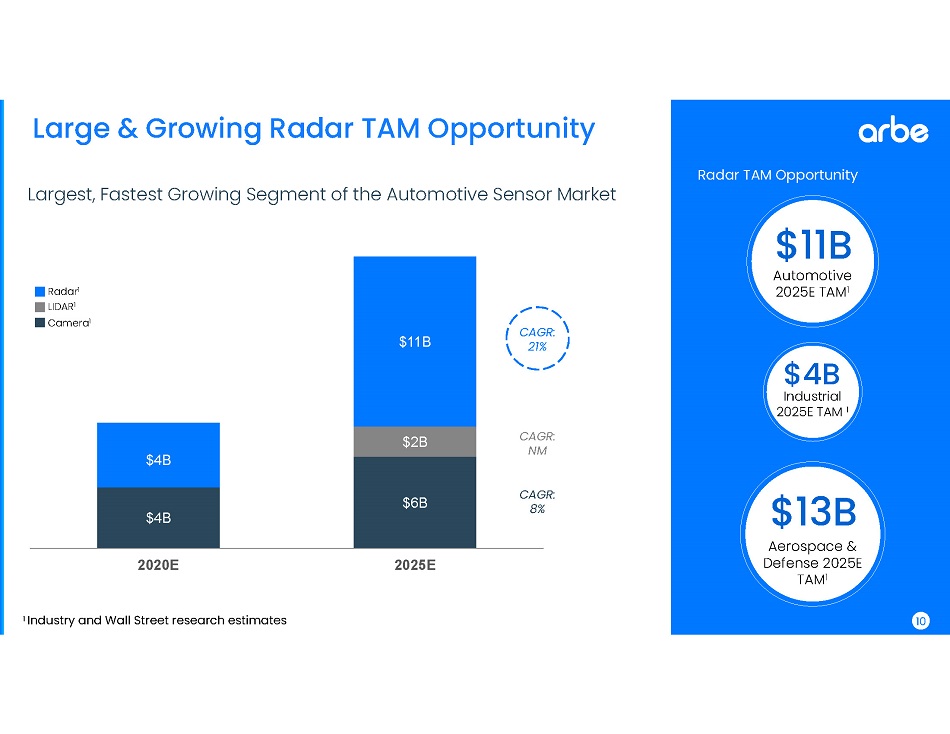

v v v $4B $6B $2B $4B $11B 2020E 2025E Large & Growing Radar TAM Opportunity Industrial 2025 E TAM 1 $ 4 B Automotive 2025 E TAM 1 $ 11 B Aerospace & Defense 2025 E TAM 1 $ 13 B CAGR: 21 % CAGR: NM CAGR: 8 % Largest, Fastest Growing Segment of the Automotive Sensor Market 1 Industry and Wall Street research estimates Camera 1 Radar 1 LIDAR 1 Radar TAM Opportunity 10

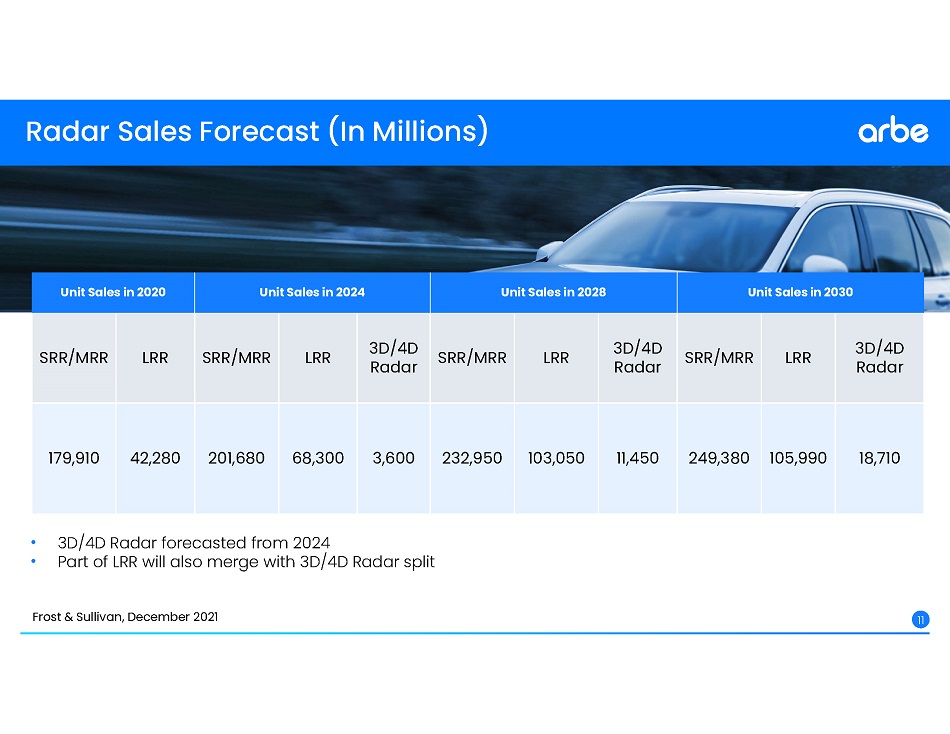

v v v Radar Sales Forecast (In Millions) • 3 D/ 4 D Radar forecasted from 2024 • Part of LRR will also merge with 3 D/ 4 D Radar split Frost & Sullivan, December 2021 Unit Sales in 2020 Unit Sales in 2024 Unit Sales in 2028 Unit Sales in 2030 SRR/MRR LRR SRR/MRR LRR 3D/4D Radar SRR/MRR LRR 3D/4D Radar SRR/MRR LRR 3D/4D Radar 179,910 42,280 201,680 68,300 3,600 232,950 103,050 11,450 249,380 105,990 18,710 11

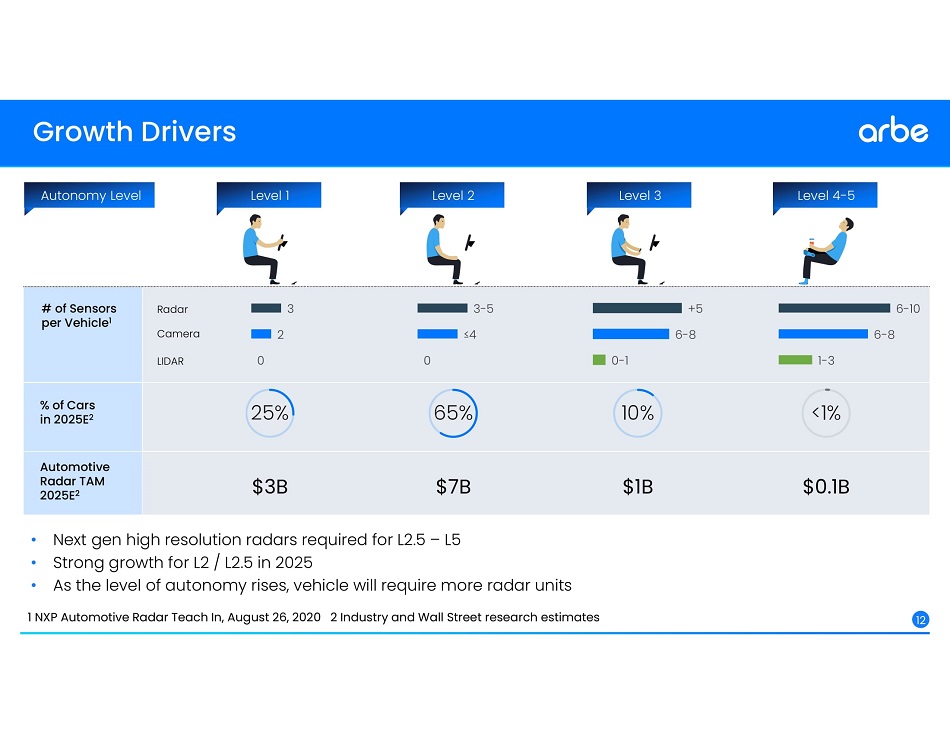

v v v # of Sensors per Vehicle 1 % of Cars in 2025 E 2 Automotive Radar TAM 2025 E 2 Growth Drivers Camera Radar LIDAR 1 NXP Automotive Radar Teach In, August 26 , 2020 2 Industry and Wall Street research estimates 12 6 - 10 6 - 8 1 - 3 $0.1B < 1 % Level 4 - 5 + 5 6 - 8 0 - 1 $ 1 B 10 % Level 3 3 - 5 ≤ 4 0 $ 7 B 65 % Level 2 3 2 0 $ 3 B 25 % Level 1 Autonomy Level • Next gen high resolution radars required for L 2.5 – L 5 • Strong growth for L 2 / L 2.5 in 2025 • As the level of autonomy rises, vehicle will require more radar units

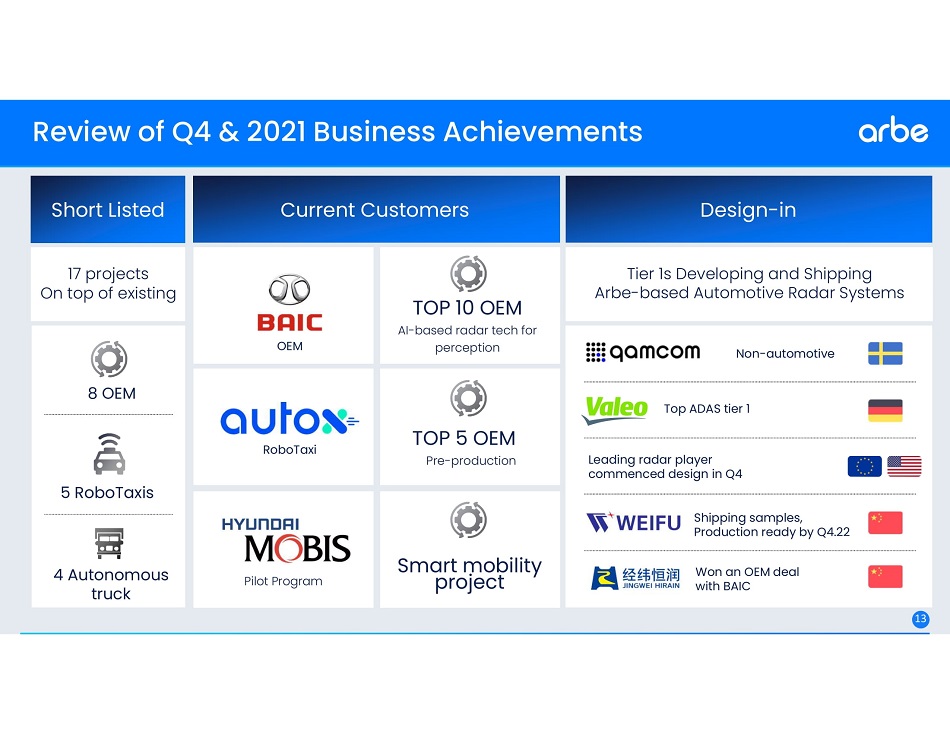

v v v 13 Review of Q 4 & 2021 Business Achievements Pilot Program RoboTaxi TOP 10 OEM AI - based radar tech for perception TOP 5 OEM Pre - production Current Customers OEM Tier 1 s Developing and Shipping Arbe - based Automotive Radar Systems Design - in Top ADAS tier 1 Non - automotive Shipping samples, Production ready by Q 4 ʡ 22 Won an OEM deal with BAIC Short Listed 8 OEM 17 projects On top of existing Smart mobility project 5 RoboTaxis 4 Autonomous truck Leading radar player commenced design in Q 4

v v v Business Growth 2020 - 2021 New Orders + 12 Customer Pilots New Short - listed Projects + ʤʪ x 6.7 X 4.7 Revenue Growth YoY 14 14

v v v Organizational Growth 15 73 to 112 53 % Total Team 62 to 90 45 % R&D + + 11 to 22 100 % SG&A +

v v v Q 4 Financial Results 3.279 11.58 0.311 0.677 0.301 1.916 Q4 2020 Q4 2021 0.194 0.52 Q4 2020 Q4 2021 R&D S&M G&A 3.891 14.173 OpEx ($M) Revenue ($M)

v v v Q 4 Financial Results 0.332 2.249 2020 2021 OpEx ($M) Revenue ($M) 12.794 28.564 1.063 1.814 1.093 3.709 2020 2021 R&D S&M G&A 14.95 34.087

v v v 2022 Business Goals 8 Design Wins Customers 2 Top Tier 1 s in the US and Europe Tier 1 s 18 Began working with Arbe

v v v Outlook $ 7 M to $ 11 M Revenues ($ 34 M) to ($ 38 M) Adjusted EBITDA

v v v On Track to 2025 On track to achieve our $ 312 million revenue goal for 2025 20

v v v The R o ad Ahead • High - definition imaging radar will change the auto market • Our solution is miles ahead of the competition • A range of new vertical opportunities will open • We intend to win significant market share by 2025 21

v v v Radar Revolution. Delivered. Thank You Kobi Marenko, CEO kobi.m@arberobotics.com