UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

For the transition period from _________ to _____________.

OR

Date of event requiring this shell company report:

Commission file number:

(Exact name of Registrant as Specified in its Charter)

(Jurisdiction of Incorporation or Organization)

(Address of Principal Executive Offices)

Tel: +

Email:

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered | ||

|

| The

| |||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of the issuer’s ordinary shares as of March 1, 2024

was

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated

filer ☐

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b)

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing

| ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No

ARBE ROBOTICS LTD.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

i

PART I

CERTAIN INFORMATION

Unless otherwise indicated or the context otherwise requires, all references in this annual report to the terms “Arbe,” the Company,” “us,” “we” and words of like import refer to Arbe Robotics Ltd., together with its subsidiaries.

Industry and Market Data

In this annual report, we present industry data, information and statistics regarding the markets in which we compete as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with our own internal estimates, taking into account publicly available information about other industry participants and our management’s judgment where information is not publicly available. This information appears in “Summary of the Annual report,” “Item 5. Operating and Financial Review and Prospects” “Item 4. Information on the Company” and other sections of this annual report.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this annual report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors” in Section D under Item 3 of this annual report. These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

Trademarks, Trade Names and Service Marks

We own or have rights to trademarks, trade names and service marks that it uses in connection with the operation of its business. In addition, our names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this annual report are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this annual report are listed without the applicable “©,” “SM” and “TM” symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” that are subject to risks and uncertainties. Statements that are not historical facts, including statements about us and the transactions contemplated by the Business Combination Agreement, and our perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding possible or anticipated future results of our business, financial condition, results of operations, liquidity, plans and objectives. The words “expect,” “believe,” “estimate,” “intend,” “plan,” “anticipate,” “project,” “may,” “will,” “could,” “should,” “potential” and similar words or expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated.

The statements contained in this annual report regarding the following matters are forward-looking by their nature:

| ● | Our projection of revenue and other operating results; |

| ● | Our expectation that we will be engaging with Tier 1 automotive suppliers and OEMs which would be building the radars based on our chipset solution, eliminating expenses associated with system completion, requirement for undertaking significant capital expenditures associated with developing mass production manufacturing and the expenses of operating any such manufacturing capability; |

1

| ● | Our expectation that radars are crucial to the automotive industry and will be deployed in nearly all new vehicles as a long range, cost-effective sensor with the fewest environmental limitations; |

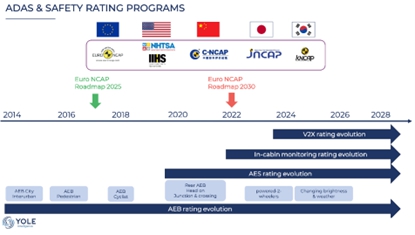

| ● | Our belief that our radar chipset heralds a breakthrough in radar technology that will enable Tier 1 manufacturers and OEMs to replace the current radars with an advanced solution that meets the safety requirements of Euro New Car Assessment Program (“Euro-NCAP”) and the United States National Highway Traffic Safety Administration (“NHTSA”) for autonomous vehicles at all levels of autonomous driving; |

| ● | Our belief that a fully autonomous vehicle is seen as a potential solution for reducing the number of traffic accidents (due to the elimination of the “human element” from the equation), and as an incentive to create innovative autonomous vehicle-sharing services that will lead to the public foregoing the purchase of private vehicles, to reduce the problem of traffic congestion, and to significantly reduce fuel consumption and air pollution; |

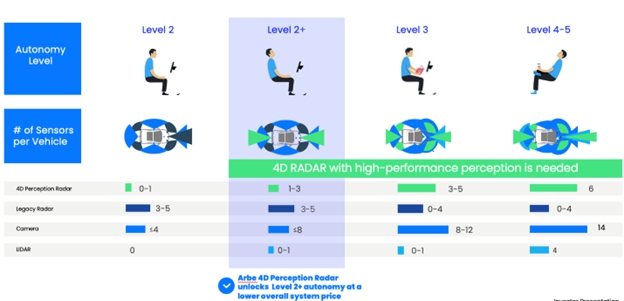

| ● | Our belief that automakers will choose to integrate advanced driver assistance systems (ADAS L2+/L3) based on several technologies simultaneously (imaging radar, camera and optionally LiDAR), and that it is likely that this trend of integrating technologies into vehicles will continue in the coming years; |

| ● | Our belief that our 4D imaging radar technology holds significant advantages for a fusion with camera over alternative technologies such as LiDAR laser systems and over current-generation radar technologies that are on the market presently or have been announced for development; |

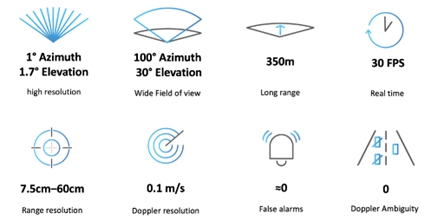

| ● | Our belief that our ground-breaking technology that contains an advanced processor, consumes relatively low amounts of energy and can scan a vehicle’s environment at an exceptionally high resolution in real-time, and identify objects and distinguish between them with great long-range accuracy and a wide field of view, differentiates us and will enable us to successfully compete and develop and maintain a leadership position in its target markets; |

| ● | Our expectation that our marketing strategy, primarily targeted at Tier 1 manufacturers, will foster cooperation with Tier 1 suppliers to integrate our radar chipsets into their radar systems to be sold to OEMs and that the Tier 1 suppliers that use our radar chipsets will be successful in marketing the systems to automakers; |

| ● | Our belief that our engagement of Global Foundries for the manufacturing and supply chain management will provide us with a more secure path in production for quality control and reliability for automotive requirements; | |

| ● | Our belief that as automakers seek to develop hands off/eyes off driving, imaging radar will become a critical ingredient and that our radar chipset will meet this need; |

| ● | Our belief that certain operational or registration requirements for some autonomous functions will be removed as state regulators gain better experience with the technology; |

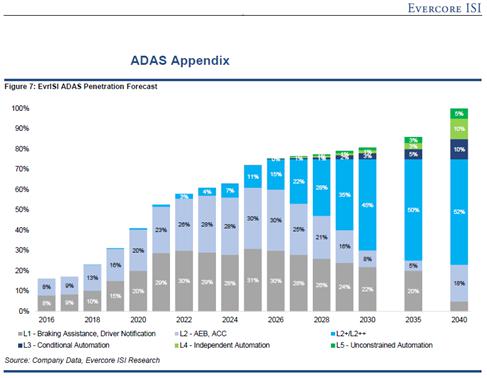

| ● | Our expectation that awareness among automakers and vehicle owners of the importance and benefits of installing ADAS and partial autonomous driving L2+/L3 (even in the absence of binding regulation) has increased, and that it is likely that in the future, the vast majority of new vehicles will be equipped with these systems; |

| ● | Our belief that our radar chipset solution will make it possible to enable the launch of an autonomous vehicle and will be the primary sensor for autonomous driving in the retail market in tandem with a camera; |

| ● | Our belief that our existing infrastructure positions us to capitalize on regulatory changes pertaining to required installation of traffic accident prevention systems in general, and radar systems in particular, which is expected to increase the demand for the technology and products that we are developing; |

2

| ● | Our belief that an increased demand for autonomous vehicles and the transition to mass production of Level 2+ and higher autonomous vehicles, requiring advanced systems for automatically integrating vehicles in traffic and preventing traffic accidents, is expected to increase the demand for products in our field of activity in the time frame we anticipate; and |

| ● | Our belief that a requirement on the part of insurance companies to install radar systems as a condition for issuing insurance policies is expected to increase the demand for our products. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks described under “Risk Factors” in Section D under Item 3 of this annual report.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this annual report, to confirm these statements to actual results or to changes in our expectations.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and indebtedness. Not Applicable |

| C. | Reasons for the offer and use of proceeds. Not Applicable. |

| D. | Risk Factors |

An investment in our ordinary shares involves significant risks. You should carefully consider all of the information in this annual report, including the risks and uncertainties described below, before making an investment in our ordinary shares. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in us. Additional risks and uncertainties not currently known to us or which we currently deem immaterial may also have a material adverse effect on our business, financial condition, results of operations, prospects and/or our share price.

Risks Related to Our Business and Industry

We are a research and development company with a history of losses and we expect to incur significant expenses and losses as we continue the development of our radar technology.

We incurred a net loss of approximately $43.5 million on revenues of approximately $1.5 million for the year ended December 31, 2023, a net loss of approximately $40.5 million on revenues of approximately $3.5 million for year ended December 31, 2022 and a net loss of approximately $58.1 million on revenues of approximately $2.2 million for the year ended December 31, 2021. No assurance can be made that we can or will become profitable. We are primarily a research and development company and we are continuing to incur research and development expenses as we work on the development of our 4D imaging radar technology. We plan the transition to production of our radar chip for sale to customers during 2024 or early 2025, although we can give no assurance that this timetable will be met. Most of our revenue to date has been generated from sales of chipsets and prototype radar systems and professional services. Until such time as we begin material commercial deliveries of our products, we will likely continue to generate losses. Even if we are able to begin making material commercial deliveries of our products, we can give no assurance that we will be successful in the commercial sale of our products.

3

We anticipate that our losses may continue to be significant as we:

| ● | Shift our research and development from production intent to production ready chipset; |

| ● | expand our production capabilities or outsources such production; |

| ● | expand our design, development, installation and servicing capabilities; |

| ● | produce chips for inventory and incur storage charges; |

| ● | incur costs in providing support and assistance to our initial commercial customers to Tier 1 suppliers as they integrate our product in their product that they market to automotive companies and to our automotive company customers as they introduce our radar in their vehicles |

| ● | incur sales and marketing activities costs and develop our distribution infrastructure; and. |

| ● | incur general and administration costs as we progress with our product development and continue to incur significant expenses in research and development as well as costs related to our status as a publicly traded corporation |

We will incur the expenses from these efforts before we receive sufficient revenues to cover our incremental expenses with respect thereto, and therefore our losses in future periods may be significant. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenues, which would further increase our losses.

Our limited operating history and evolving business model makes evaluating our business and future prospects difficult and may increase the risk of your investment.

We have focused primarily on developing our 4D imaging radar technology products since 2017 and did not generate any revenue until 2020. Our relatively limited operating history and modest level of revenue to date make it difficult to evaluate our future prospects and the risks and challenges we may encounter. Further, because we have limited historical financial data and operate in a rapidly evolving market, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a history of sales in commercial quantities or if we operated in a more predictable market rather than a market that is itself a developing market that is developing at a slower rate than we had anticipated.

In late 2023 we broadened our focus to seek contracts with Tier 1 suppliers and OEMs for orders in commercial quantity in addition to sales of radars for testing purposes. If this strategy is not successful, and we do not generate orders for commercial quantities of our products, we may incur increased losses. In this connection, as both our business and the market for ADAS vehicles develops, our operations may undergo other changes that result is a material change in our business and the direction of our business. Any such modifications could result in increased losses (as pivoting the business may be costly) and future results may differ materially from those presented herein.

4

Any change in our business model may make the results of our operations to date less useful in evaluating our business and prospects.

If we fail to address the risks and difficulties that we face, including those described elsewhere in this “Risk Factors” section, our business, financial condition and results of operations could be impaired. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, the results of our operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

We expect to continue to invest substantially in research and development to develop and commercialize new products, and these investments could significantly increase our losses and may not generate significant revenue for us.

Our future growth depends on maintaining our technological leadership in order to introduce new products that achieve market acceptance and penetrate new markets. Our research and development expenses were approximately $34.1 million in 2023, $36.7 million for 2022 and approximately $28.6 million for 2021. We expect that our research and development expenses are likely to continue to be significant in the future as we seek to expand our research and development effort to meet the anticipated market need. Because we expense our research and development activities, as we increase these expenses it will adversely affect the results of our operations. In addition, our research and development program may not produce successful results, and even if it does successfully produce new products, those products may not achieve market acceptance, create additional revenue or become profitable. Because the market for our products is both leading edge technology in an evolving industry, we can only be successful if we can offer leading edge technology. Our failure to offer leading edge technology can materially impair our ability to operate profitably.

Agreements with customers may not generate the anticipated revenue as we are subject to the risks of cancellation or postponement of contracts or unsuccessful implementation.

Prospective customers of our products generally must make significant commitments of resources to test and validate our products and confirm that they can integrate our products with other technologies before including our products in any particular system, product or model. The development cycles of our products with new customers vary widely depending on the application, market, customer and the complexity of the product. In the automotive market, for example, this development cycle can be over several years. As a result of these lengthy development cycles, we spend significant time and resources to have our products selected by potential customers for a particular use. If we fail to secure such relationships, we may not have an opportunity to supply our products within a sector with such a long lead time for a period of several years. Further, we are subject to the risk that customers that order products, which are subject to the customer’s ability to integrate the product with its other systems, may cancel or postpone orders if the customer is not satisfied that our product and service meet the customer’s requirements.

The development cycle of products using our technology as well as the market for our products that are under development can be impacted by various factors which cannot be predicted, including international conflicts, climate and weather conditions, global economic conditions and customer trends.

The development process for our products as well as the timing of our sales and the market for our products can be affected by various factors, many of which are unpredictable. These factors include such conditions as international conflicts, climate and weather conditions, significant natural disasters such as the outbreak of a pandemic, such as COVID-19, or other catastrophic events. In recent months the following conditions have affected or may affect various aspects of our business.

| ● | The effects of the attack by Hamas on October 7, 2023 and the war between Israel and Hamas which is continuing as of the date of this report and is discussed below under the Risk Factor “Risks Related to our Incorporation and Location in Israel -- Conditions in Israel could materially and adversely affect our business.” | |

5

| ● | The effects of the February 24, 2022 invasion by the Russian Federation of Ukraine, which is ongoing and is discussed below. |

| ● | Extreme weather conditions that may adversely affect manufacturing facilities of our suppliers and/or customers, and cause material delays in our supply chain or to our forecasted orders. |

| ● | The effects of any other military conflicts and cybersecurity actions; and |

| ● | Any other conditions which may affect the automotive industry generally and the ability of automotive companies in their evaluation and purchase of our products or our ability and the ability of our customers and potential customers to evaluate our product or order our product. |

Any factors which affect the ability or willingness of customers and potential customers to test our products or purchase our products could materially impair our ability to develop our business, We cannot predict the extent that any of the foregoing will impact our business nor what other factors which we do not presently contemplate may impact our business; however, any of these factors, as well as other factors not presently contemplated, may have a material adverse effect upon our business.

We may need to raise additional funds in the future in order to execute our business plan and these funds may not be available to us when it needs them. If we cannot raise additional funds when we need them, our business, prospects, financial condition and operating results could be negatively affected.

We are presently primarily a research and development company, as we are continuing to spend significantly more in research and development than we are generating in revenue. Although our working capital at December 31, 2023 was approximately $41.2 million, we may nonetheless require additional capital in order to fund our growth strategy and to respond to technological advancements, competitive dynamics or technologies, customer demands, business opportunities, challenges, acquisitions or unforeseen circumstances, and we intend to seek funding through equity, debt or convertible debt financing.

We may not be able to timely secure such debt or equity financing on favorable terms, or at all. If we raise additional funds through the issuance of equity or convertible debt or other equity-linked securities, our shareholders could experience significant dilution. In addition, any debt financing we may obtain in the future, whether in the form of a credit facility, convertible debt could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to grow or support its business and to respond to business challenges could be significantly limited. In addition, because our decision to issue debt or equity in the future will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing, nature or success of our future capital raising efforts.

If market adoption of our products does not develop, or develops more slowly than we expect, our business will be adversely affected.

While our products can be applied for uses in different markets, many of our products are still relatively new in the market and it is possible that other technologies and devices, based on new or existing technology or a combination of technologies, will achieve acceptance or leadership as compared to our existing or future product lines. Even if our products are used, we cannot guarantee that our products will be designed into or included in subsequent generations of such commercialized technology. In addition, we expect that widescale use of our products may lag behind these initial applications significantly. The speed of market growth for our products is difficult if not impossible to predict. In addition, to the extent that a market for our products develops successfully, we expect that there will be increasing competition from alternative providers and other modalities. If we are not successful in commercializing our products in a timely manner, or not as successful as we expect, or if other modalities gain acceptance by our potential customers, regulators and safety organizations or other market participants, our business, results of operations and financial condition will be materially and adversely affected.

6

We may not be able to accurately estimate the supply and demand of our products, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements, we could incur additional costs or experience delays.

It is difficult to predict our future revenues and budget for our expenses, and we may have limited insight into trends that may emerge and affect our business. We expect that we will be required to provide forecasts of our demand to our potential customers several months prior to the scheduled delivery date. Currently, because it is a developing market, there is little historical basis for making judgments on the demand for our products or our ability to develop, produce, and deliver products, or our profitability in the future. If we overestimate our requirements, we or our potential suppliers may have excess inventory, which indirectly would increase our costs. If we underestimate our requirements, we or our potential suppliers may have inadequate inventory, which could interrupt the manufacturing of our products and result in delays in shipments, which is likely to affect revenue and customer relations. In addition, lead times for materials and components that our potential suppliers order may vary significantly and depend on factors such as the specific supplier, contract terms and demand for each component at a given time. If we fail to order sufficient quantities of product components in a timely manner, the delivery of products to our potential customer base could be delayed, which would harm our business, financial condition and operating results.

We target many customers that are large companies with substantial negotiating power, exacting product standards and potentially competitive internal solutions. If we are unable to sell our products to these customers, our prospects and results of operations will be adversely affected.

Many of our customers and potential customers are large, multinational companies with substantial negotiating power relative to us and, in some instances, may have internal solutions that are competitive with our products. These large, multinational companies also have significant resources, which may allow them to acquire or develop competitive technologies either independently or in partnership with others. Accordingly, even after investing significant resources to develop a product, we may not secure a design win or may not be able to commercialize a product on profitable terms. Because our products are a key aspect of the safety of vehicles that use our products and must comply with international standards, our products will be held to a stringent safety test before they are included in a vehicle. If our products are not selected by these large companies or if these companies develop or acquire competitive technology or negotiate terms that are disadvantageous to us, it will have an adverse effect on our business.

Our principal customers include Tier-1 suppliers with a view to including our chipset as part of a radar system that they market to the automobile industry and which compete with other Tier 1 suppliers in marketing to the automotive industry.

Many of our customers and potential customers are either large, multinational Tier-1 companies which market radar systems that include our chipset in the systems they market to the automotive industry, including OEMs, or large multinational automobile companies. Thus, we are dependent upon the ability of our Tier 1 suppliers to market their systems to the automotive industry. To the extent our product is part of a radar that is offered by such Tier-1 supplier, we depend on the ability of the Tier-1 supplier to successfully market and sell its product (which includes our product) to the OEM’s, many times following a bid process conducted by the OEM. Accordingly, even after investing significant resources to develop a product, we largely rely on our Tier-1 customers’ efforts to secure a design win in order to be able to commercialize our product on profitable terms. Because our products are a component on a complete radar product offered by our Tier-1 customer to the OEM, if the radar products are not selected by these large OEM companies or if these OEM companies develop or acquire competitive technology or negotiate terms that are disadvantageous to us, it will have an adverse effect on our business. We also market directly to automobile manufacturers and seek to include our radar system in their automobiles. To the extent that we are not successful in marketing to the automotive industry our business will be materially impaired.

7

We continue to work with other companies, including our sole supplier and our Tier 1 companies to develop our business, and these initiatives may prove more costly than we currently anticipate, and we may not succeed in generating sufficient revenue to operate profitability.

We continue to make investments and implement initiatives designed to grow our business, including:

| ● | investing in research and development; |

| ● |

working with Tier 1 suppliers to develop a radar product based on our chipsets with a view to the Tier 1 marking this product to the automotive and related markets;

| |

| ● | expanding our sales and marketing efforts to attract new customers in new industries; |

| ● | investing in new applications and markets for our products; |

| ● | further enhancing our manufacturing processes and relationships; and |

| ● | incurring in legal, accounting, and other administrative functions necessary to support our operations as a public company. |

These initiatives may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue, if at all, in an amount sufficient to offset these higher expenses and to achieve and maintain profitability. The market opportunities we are pursuing are being developed, and it may be years before the markets we expect to serve generate significant demand for our products at scale, if at all.

In addition, our revenue may be adversely affected for a number of reasons, including the development and/or market acceptance and timing of market introduction of new technology that competes with our products, changes by other market participants with respect to their acceptance or implementation of our technology, failure of our customers to commercialize autonomous systems that include our products, our inability to effectively manage our inventory or manufacture products at scale, our failure to enter new markets or to attract new customers or expand orders from existing customers or due to increasing competition. Furthermore, it is difficult to predict the size and growth rate of our target markets, customer demand for our products, commercialization timelines, developments in autonomous sensing and related technology, the entry of competitive products, or the success of existing competitive products and services. Accordingly, we do not expect to achieve profitability over the near term. If our revenue does not grow over the long term, our ability to achieve and maintain profitability may be adversely affected, and the value of our business may significantly decrease.

The markets in which we compete are characterized by rapid technological change, which requires us to continue to develop new products and product innovations and could adversely affect market adoption of our products.

While we intend to invest substantial amounts in research and development, continuing technological changes in our technology and competitive technologies could adversely affect adoption of our products. Our future success will depend upon our ability to develop and introduce a variety of new capabilities and innovations to our existing product offerings, as well as to introduce a variety of new product offerings to address the changing needs of the markets in which we offer our products. Delays in delivering new products that meet customer requirements could damage our relationships with customers and lead them to seek alternative sources of supply.

If we are unable to develop products or system configurations that meet customer requirements, including pricing, on a timely basis or that remain competitive with other technological alternatives, our products could lose market share, our revenue will decline, it may experience operating losses and our business and prospects will be adversely affected.

Certain of our development and supply arrangements could be terminated or may not materialize into long-term contracts.

We have arrangements with Tier 1 suppliers and other companies for the development of products or for the incorporation of our products in a customer’s products. Some of these arrangements are evidenced by memorandums of understandings and early-stage agreements that are used for design and development purposes but that will require renegotiation at later stages of development or replacement by production or master agreements that have yet to be implemented under separately negotiated statements of work, each of which could be terminated or may not materialize into next-stage contracts or long-term contract arrangements. If these arrangements are terminated or if we are unable to enter into next-stage contracts or long-term operational contracts, our business, prospects, financial condition and operating results may be materially adversely affected.

8

We will be subject to risks associated with our agreements with Tier 1s and other companies.

If we are successful in entering into definitive agreements with potential suppliers, including Tier 1s, these arrangements will subject us to risks, including risks associated with non-performance by the third party and sharing proprietary information, any of which may materially and adversely affect our business and prospects. Because of our limited ability to monitor or control the actions of these third parties, to the extent any of these strategic third parties suffer negative publicity or harm to their reputation from events relating to their business, we may also suffer negative publicity or harm to our reputation by virtue of our association with any such third party. In addition, a third party may have different priorities than we have with the effect that the supplier may not give our products the priority that we consider important, which could impair our ability to generate revenue.

We may experience difficulties in managing our growth and expanding our operations.

We expect to experience significant growth in the scope and nature of our operations. Our ability to manage our operations and future growth will require us to continue to improve our operational, financial and management controls, compliance programs and reporting systems. We are currently in the process of strengthening our compliance programs, including those related to export controls, privacy and cybersecurity and anti-corruption and financial controls. We may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing controls, programs, systems and procedures, which could have an adverse effect on our business, reputation and financial results.

Continued pricing pressures may result in lower than anticipated margins or losses, which may adversely affect our business.

Cost-cutting initiatives adopted by our Tier-1 customers and automobile and other automotive customers as well as the effects of competition may result in increased downward pressure on pricing. We expect that as our industry develops and competition grows, our agreements with existing customers may require step-downs in pricing over the term of the agreements or, if commercialized, over the periods of production, and we may not be able to negotiate price reductions from our suppliers. In addition, our existing or future customers may reserve the right to terminate their supply contracts for convenience, which enhances their ability to obtain price reductions. Certain large customers may possess significant leverage over their suppliers, including us, because the market is highly competitive. Accordingly, we expect to be subject to substantial continuing pressure from our existing and prospective customers to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as automotive OEMs pursue restructuring, consolidation and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset price reductions, our gross margin and profitability would be adversely affected. Further, to the extent that the specifications of our chips result in prices which are not competitive, our sales and gross margin may be impaired and we may not be able to operate profitably.

Adverse conditions within our industry or the global economy more generally could have adverse effects on our results of operations.

Our business is directly affected by and significantly dependent on business cycles and other factors affecting the global automobile industry and the global economy generally. Production and sales within our industry are cyclical and depend on general economic conditions and other factors, including consumer spending and preferences, the timing by automobile manufacturers as to the introduction autonomous features that require our technology, changes in interest rates and credit availability, consumer confidence, fuel costs, fuel availability, environmental impact, governmental incentives and regulatory requirements and political volatility. In addition, production and sales can be affected by our customers’ ability to continue operating in response to challenging economic conditions, regulatory requirements and other factors. Any significant adverse change in any of these factors may result in a reduction in automotive sales and production by our customers and could have a material adverse effect on our business, results of operations and financial condition.

9

Use of our products for markets other than the automotive market may not develop or may develop much more slowly than we anticipate, which would adversely affect our business and prospects.

We are investing in and pursuing market opportunities in various sectors and industries in addition to the automobile industry, such as autonomous delivery vehicles or robotaxies, delivery robots, autonomous trucks, agriculture, infrastructure and traffic systems. We believe that our ability to increase our revenue will depend in part on our ability to identify potential new markets and develop products and implements a marketing plan aimed at these new markets as they emerge. Each new market presents distinct risks and, in many cases, requires us to address the particular requirements of that market.

Addressing these requirements can be time-consuming and costly. The market for our existing products and technology outside of our core customer base is relatively new, rapidly developing and unproven in many markets or industries. Many of the participants in the markets for our core technology outside of our existing target industries are still in testing and developing and may not succeed in commercializing some of our products. We cannot be certain that our products will be sold into these markets, or any market outside of where we currently operate, at scale. Adoption of our products outside of the automotive industry will depend on numerous factors, including: whether the technological capabilities of similar products meet users’ current or anticipated needs, whether the benefits of designing products such as our products into larger systems outweigh the costs, complexity and time needed to deploy such technology or replace or modify existing systems that may have used other modalities, whether users in other applications can move beyond the testing and development phases and proceed to commercializing systems supported by our technology and whether developers of products such as our products can keep pace with rapid technological change in certain developing markets and the global response to supply chain delays. If technology developed by us does not achieve commercial success outside of the automotive industry, or if the market develops at a pace slower than we expect, our business, results of operation and financial condition may be materially and adversely affected.

We may be subject to the effects of inflationary pressures, which may impair our gross margins and our ability to operate profitably.

Although we do not believe that our business was adversely affected by inflation prior to 2023, we have been experiencing cost increases, including increased labor costs, as a result of the recent inflationary pressures, combined with supply line delays and recent shortages of semiconductors. The effects of the war in Israel, the Russian invasion of Ukraine, which exacerbated the already existing inflationary pressures and supply line delays and shortages, may impair our margin and our ability to operate profitable. To the extent that inflation, along with supply line delays and semiconductor shortages, we may incur increased costs in our components as well as from our contract manufacturers, and we may not be able to pass on any costs we may incur to our customers. To the extent that we are unable to pass on costs, our gross margin may be significantly eroded which may result in increased losses during our developmental phase and may impair our ability to operate profitable when we are in full production mode. We cannot assure you that these factors will not impair our ability to generate a profit from our operations.

If we seek to expand our business through acquisition, we may not be successful in identifying acquisition targets or integrating their businesses with our existing business.

From time to time, we may undertake acquisitions to add new products and technologies, acquire talent, gain new sales channels or enter into new markets or sales territories. To date, we have no experience either with acquisitions or the integration of acquired technology and personnel.

There are significant risks associated with any acquisition program, including, but not limited to, the following:

| ● | We may incur significant expenses and devote significant management time to the acquisition and we may be unable to consummate the acquisition on acceptable terms. |

10

| ● | If we identify an acquisition, we may face competition from other companies in the industry or from financial buyers seeking to make the acquisition. |

| ● | The integration of any acquisition with our existing business may be difficult and, if we are not able to integrate the business successfully, it may not only be unable to operate the business profitably, but management may be unable to devote the necessary time to the development of our existing business; |

| ● | The key employees who operated the acquired business successfully prior to the acquisition may not be happy working for us and may resign, thus leaving the business without the necessary continuity of management. |

| ● | Even if the business is successful, our senior executive officers may need to devote significant time to the acquired business, which may distract them from their other management activities. |

| ● | If the business does not operate as we expect, we may incur an impairment charge based on the value of the assets acquired. |

| ● | We may have difficulty maintaining the necessary quality control over the acquired business and our products and services. |

| ● | To the extent that an acquired company operates at a loss prior to our acquisition, we may not be able to develop profitable operations following the acquisition. |

| ● | Problems and claims relating to the acquired business that were not disclosed at the time of the acquisition may result in increased costs and may impair our ability to operate the acquired company. |

| ● | The acquired company may have liabilities or obligations that were not disclosed to us, or the acquired assets, including intellectual property assets, may not have the value we anticipated. |

| ● | Any indemnification obligations of the seller under the purchase agreement may be inadequate to compensate us for any loss, damage or expense that we may sustain, including undisclosed claims or liabilities. |

| ● | To the extent that the acquired company is dependent upon our management to maintain relationships with existing customers, we may have difficulty in retaining the business of these customers if there is a change in management. |

| ● | Government agencies may seek damages after we makes the acquisition for conduct that occurred prior to the acquisition and we may not have adequate recourse against the seller. |

| ● | We may require significant capital both to acquire and to operate the business, and the capital requirements of the business may be greater than we anticipated, and our failure to obtain capital on reasonable terms may impair the value of the acquisition and may impair our continuing operations. |

| ● | The acquired company may be impacted by unanticipated events, such as a pandemic such as the COVID-19 pandemic, the effect of climate changes, terrorist or other disruptive activities in Israel, social unrest or other factors over which we may have no control. |

If any of these risks occur, our business, financial condition and prospects may be impaired.

11

The complexity of our products could result in unforeseen delays or expenses from undetected defects, errors or bugs in hardware or software which could reduce the market adoption of our products, damage our reputation with current or prospective customers, expose us to product liability, recalls, warranties and other claims and adversely affect its operating costs.

Our products are being designed to be, among other things, compatible with autonomous control. Autonomous driving technologies are subject to risks and there have been accidents and fatalities associated with such technologies as well as breakdowns of the systems. The safety of such technologies depends in part on user interaction and users, as well as other drivers on the roadways, may not be accustomed to using or adapting to such technologies. To the extent accidents associated with our products that are used with autonomous controls occur, we could be subject to liability, negative publicity, government scrutiny and further regulation. Any of the foregoing could materially and adversely affect our results of operations, financial condition and growth prospects.

Our products are technologically complex and require high standards to manufacture. We have experienced in the past and will likely also experience in the future defects, errors or bugs at various stages of development and manufacturing. We may be unable to timely release new products, manufacture existing products, correct problems that have arisen or correct such problems to our customers’ satisfaction. Additionally, undetected errors and defects, especially as new products are introduced or as new versions are released, could result in serious injury, including fatalities, to the end users of technology incorporating our products, or those in the surrounding area, our customers never being able to commercialize technology incorporating our products, litigation against us, negative publicity and other consequences. These risks are particularly prevalent in the highly competitive markets in which we operate. Some errors or defects in our products may only be discovered after they have been tested, commercialized and deployed by customers. In certain instances, we may provide our customers with a time-limited warranty for our products. If such errors or defects occur within the respective warranty period, we may incur significant additional development costs and product recall, repair or replacement costs. These problems may also result in claims against us by our customers or by third parties. Our reputation or brand may be damaged as a result of these problems and customers may be reluctant to buy our products, which could adversely affect our ability to retain existing customers and attract new customers and could adversely affect our financial results.

In addition, we could face material legal claims for breach of contract, product liability, tort or breach of warranty as a result of these problems. Defending a lawsuit, regardless of its merit, could be costly and may divert management’s attention and adversely affect the market’s perception of us and our products. In addition, our business liability insurance coverage could prove inadequate with respect to a claim and future coverage may be unavailable on acceptable terms or at all. These product-related issues could result in claims against us and our business could be adversely affected.

We will be affected by these problems regardless of whether the defective product or component was manufactured or assembled by us or by a supplier or contract manufacturer, and we may not have adequate recourse against the supplier or contract manufacturer, and we may not be able to obtain sufficient product liability insurance to protect it against such loss or expense, including the cost of litigation.

Legislation or government regulations may be adopted which may affect our products and liability.

Autonomous driving technology is subject to considerable regulatory uncertainty as the law evolves to catch up with the rapidly evolving nature of the technology itself, all of which are beyond our control. Our products also may not achieve the requisite level of autonomous compatibility required for certification and rollout to consumers or satisfy changing regulatory requirements which could require us and the Tier 1 suppliers that develop and market products based on our chipset to redesign, modify or update our or their products. Further, accidents, particularly accidents that involve a large number of deaths, even if our products are not involved, may result in industry-wide reevaluation of the technologies used, with the effect that there is a slowdown as automobile manufacturers cease making purchase during the reevaluation process, which may result in suppliers other than us becoming a preferred supplier.

The industry may become subject to increased legislation and regulation. Such legislation may be triggered by a perceived safety concern, or it may result from a public reaction to accidents caused by automobiles, drones or other autonomous vehicles. The potential market for our products is international, and each country or region may impose different regulations. These regulations may relate the technical requirement and standards for end products or the components and may impose liability on the manufacturer or the seller of the product, which liability may be strict liability, for damage resulting from the autonomous vehicle. Further, the legislation or regulations in different countries may impose different standards, which may be conflicting. Any legislation or regulations that impose standards or impose liability are likely to increase our manufacturing costs as well as the cost of compliance and product liability insurance.

12

We operate in a highly competitive market against a large number of both established competitors and new market entrants, and some market participants have substantially greater resources than we have.

The markets for sensing technology applicable to autonomous solutions across numerous industries are highly competitive. Our future success will depend on our ability to maintain our ability to develop and protect from in a timely manner and to stay ahead of existing and new competitors and to satisfy the market that is technology is leading edge technology. A large number of companies offer radar-based and LiDAR-based technologies in competition with us. Some of these companies are better capitalized and better known than we. Our competitors compete with us directly by offering similar products and indirectly by attempting to solve some of the same challenges with different technology. We face competition from other market participants, some of which have significantly greater resources than we have. Our competitors may commercialize new technology which may achieve market adoption or stronger brand recognition as compared to our products. Even in emerging markets, we face substantial competition from numerous competitors seeking to prove the value of their technology. Additionally, increased competition may result in pricing pressure and reduced margins and may impede our ability to increase the sales of our products or cause it to lose market share, any of which will adversely affect our business, results of operations and financial condition.

Fluctuation of the results of our earnings on a quarterly and annual basis, could cause the share price of the our ordinary shares to fluctuate or decline.

We are currently a research and development company, and the results of our operations to date have primarily reflected our research and development expenses. Commencing 2020 through 2023, we had modest revenue from sales of our products and services, primarily to customers making purchases for their own evaluation projects. In the future, sales in any given quarter can fluctuate based on the timing and success of our customers’ development projects and marketing programs. Accordingly, the results of any one quarter should not be relied upon as an indication of future performance. Our quarterly financial results may fluctuate as a result of a variety of factors, many of which are outside of our control and may not fully reflect the underlying performance of our business. These fluctuations could adversely affect our ability to meet our expectations or those of securities analysts or investors. If we do not meet these expectations for any period, the value of our business and our securities could decline significantly. Factors that may cause these quarterly fluctuations include, without limitation, those listed below:

| ● | The timing and magnitude of orders and shipments of our products in any quarter; |

| ● | Pricing changes we may adopt to drive market adoption or in response to competitive pressure; |

| ● | The effect of supply line problems affecting us and our suppliers or customers; |

| ● | The effect of inflation; |

| ● | The timing of the completion of our application engineering services; |

| ● | Our ability to retain our existing customers and attract new customers; |

| ● | Our ability to develop, introduce, manufacture, and ship products in a timely manner that meet customer requirements; |

| ● | Disruption in our sales channels or termination of our relationships with important channel partners; |

| ● | Delays in customers; purchasing cycles or deferments of customers; purchases in anticipation of new products or updates from us or our competitors; |

| ● | Fluctuations in demand pressures for our products; | |

13

| ● | The mix of products sold in any quarter; |

| ● | The duration of, and responses of governments and industry to any worldwide or regional health crisis; |

| ● | Events and conditions affecting Israel-based businesses; |

| ● | The timing and rate of broader market adoption of autonomous systems, both generally and those utilizing our smart vision solutions across automotive and other market sectors; |

| ● | Market acceptance of our core products and further technological advancements by us, our competitors, and other market participants; |

| ● | The ability of our customers to commercialize systems that incorporate our products; |

| ● | Any change in the competitive dynamics of our markets, including the consolidation of competitors, regulatory developments, and new market entrants; |

| ● | Our ability to effectively manage our inventory; |

| ● | Changes in the source, cost, availability, and regulations pertaining to the materials we use; |

| ● | Adverse litigation, judgments, settlements, or other litigation-related costs, or claims that may give rise to such costs; |

| ● | Adverse publicity, litigation, and governmental investigations affecting autonomous vehicles, regardless of whether our products are involved; |

| ● | The war with Hamas, any other conflicts which may involve Israel and the effects of the Russian invasion of Ukraine; and |

| ● | General economic, industry, and market conditions, including trade disputes. |

Changes in tax laws or exposure to additional income tax liabilities could affect our future profitability.

Factors that could materially affect our future effective tax rates include but are not limited to:

| ● | New income or other tax laws or regulations could be enacted at any time, which could adversely affect our business operations and financial performance. Further, existing tax laws and regulations could be interpreted, modified, or applied adversely to us. |

| ● | Actual or perceived political instability in Israel or any negative changes in the political environment may, individually or in aggregate, adversely affect the Israeli economy and, in turn, may result in major changes in Israeli tax laws, regulations and tax policies. |

| ● | Changes in accounting and tax standards or practices; |

| ● | Eligibility for beneficial treatment under Israeli tax laws; |

| ● | Changes in the composition of operating income by tax jurisdiction; |

| ● | Our operating results before taxes; and |

| ● | Our ability to use our accumulated tax losses to offset future income. |

14

|

We may be subject to regular review and audit by Israeli and other foreign tax authorities. Although we believe our tax estimates are reasonable, the authorities in these jurisdictions could review our tax returns and impose additional taxes, interest, linkage and penalties, and the authorities could claim that various withholding requirements apply to us or our subsidiaries or assert that benefits of tax treaties are not available to us or our subsidiaries, any of which could materially affect our income tax provision, net income, or cash flows in the period or periods for which such determination and settlement is made. Our determinations are not binding on any taxing authorities, and accordingly the final determination in an audit or other proceeding may be materially different than the treatment reflected in our tax provisions, accruals and returns. An assessment of additional taxes because of an audit could have a material adverse effect on our business, financial condition, results of operations and cash flows.

|

There can be no assurance that our effective tax rate will not increase over time as a result of changes in corporate income tax rates or other changes in the tax laws in the jurisdictions in which we operate. Any changes in tax laws could have an adverse impact on our financial results. Corporate tax reform, base-erosion efforts and tax transparency continue to be high priorities in many tax jurisdictions where we have business operations. As a result, policies regarding corporate income and other taxes in numerous jurisdictions are under heightened scrutiny, and tax reform legislation is being proposed or enacted in a number of jurisdictions.

The tax benefits that may be available to us require that we continue to meet various conditions and may be terminated or reduced in the future, which could increase our costs and taxes.

Changes in our product mix may impact our financial performance.

Our financial performance can be affected by the mix of products we sell during a given period. If our sales include more lower-gross margin products than higher gross margin products, our results of operations and financial condition may be adversely affected. There can be no guarantees that we will be able to successfully alter our product mix so that we are selling more of our high-gross margin products. In addition, our earnings forecasts and guidance are expected to include assumptions about product sales mixes. If actual results vary from this projected product mix of sales, our results of operations and financial condition could be adversely affected.

We are highly dependent on the services of our co-founders, who are our senior executive officers.

We are highly dependent on our co-founders, Kobi Marenko and Noam Arkind, who have acted as our Chief Executive Officer and Chief Technology Officer, respectively, since inception, and as such, are deeply involved in all aspects of our business, including product development. The loss of either of them would adversely affect our business because it could be more difficult for us to, among other things, compete with other market participants, manage our research and development activities, and retain existing customers or cultivate new ones. Negative public perception of, or negative news related to, Mr. Marenko or Mr. Arkind may adversely affect our brand, relationship with customers, or standing in the industry.

Our business depends on our ability to attract and retain highly skilled personnel and senior management. Failure to effectively retain, attract and motivate key employees could impair our ability to operate profitably.

Competition for highly skilled personnel is often intense, especially in Israel, where our principal office is located, and we may incur significant costs to attract them. We may face challenges in attracting or retaining qualified personnel to fulfill our current or future needs. The highly competitive environment for highly skilled personnel can result in higher compensation packages for employees. We have, from time to time, experienced, and we expect to continue to experience, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. In addition, job candidates and existing employees often consider the value of the equity awards they receive in connection with their employment. If the perceived value of our equity or equity awards declines, it may adversely affect our ability to retain highly skilled employees. Our stock price may affect their decision as to whether to accept an offer of employment from us. Our success will depend in part on the attraction, retention, and motivation of executive personnel critical to our business and operations. If we fail to attract new personnel or fail to retain and motivate our current personnel, we could face disruptions in our operations, strategic relationships, key information, expertise, or know-how, and unanticipated recruitment and onboarding costs, and our business and future growth prospects could be adversely affected. We cannot give assurance that we will be able to hire all the required personnel when we require them.

15

We face numerous risks associated with commercial production.

We do not have manufacturing facilities, and we rely on third parties for the manufacture of our products. We cannot be sure that our manufacturer, GlobalFoundries, or other companies with which we may develop a strategic alliance will be able to develop efficient, automated, cost-efficient production capabilities and processes and reliable sources of component supply that will enable us to meet the quality, price, engineering, design and production standards, as well as the production volumes, required to successfully mass market our products. GlobalFoundries is a major semiconductor manufacturer in the automotive industry, among other industries. Even if we and our supplier and strategic alliances are successful in developing our initial production and further high volume production capability and processes and reliably sourcing our component supply, we do not know whether we will be able to do so in a manner that avoids significant delays and cost overruns, including as a result of factors beyond our control such as problems with potential suppliers and strategic partners, force majeure events, or in time to meet our product commercialization schedules or to satisfy the requirements of our potential customer base. Any failure to develop such production processes and capabilities within our projected costs and timelines could have a material adverse effect on our business, prospects, financial condition, and operating results.

We rely on third-party suppliers, and because key components in our products come from limited or sole sources of supply, we are susceptible to supply shortages, long lead times for components, and supply changes, any of which could disrupt our supply chain and delay deliveries of our products to customers.

The components that go into the manufacture of our solutions are sourced from third-party suppliers. Some of the key components used to manufacture our products come from limited or single-source suppliers. We are therefore subject to the risk of shortages and long lead times in the supply of these components, as well as the risk that our suppliers will discontinue or modify components used in our products. We purchase semiconductor chips that are an integral part of our products from GlobalFoundries. To the extent that our Tier 1 suppliers modify their products, it may be necessary for us to make modifications to the chipset that we sell to the Tier 1 supplier, and we would need to work with GlobalFoundries, to develop and produce a modified product to meet the Tier 1 supplier’s cost and timing requirements. If GlobalFoundries fails to deliver or delays the delivery of the semiconductor products or is otherwise unable to meet our quality and delivery requirements, we may be required to seek an alternative source of supply. Although alternate chip manufacturers are available, any change in suppliers would necessitate a change in the design of the semiconductor, a process that could take up to two years, which would result in a loss of sales and a delay in the development and marketing of our products, which could materially and adversely affect our results of operation, financial position, and prospects. Further, we, like other companies in the automotive industry, are affected by an industry-wide semiconductor shortage, which results, in part, from the effects of the COVID-19 pandemic and the Russian invasion to Ukraine.

Reliance on third-party manufacturers reduces our control over the manufacturing process, including our ability to finalize changes through validation, reduced control over quality, product costs, and product supply and timing. We may experience delays in shipments or issues concerning product quality from our third-party manufacturers. If GlobalFoundries experiences interruptions, delays, or disruptions in supplying our products, including by natural disasters, other health epidemics and outbreaks, work stoppages, capacity constraints, the effects of the war between Israel and Hamas, or other international conflicts, our ability to ship products to distributors and customers would be delayed. In addition, unfavorable economic conditions could result in financial distress among third-party manufacturers upon which we rely, thereby increasing the risk of disruption of supplies necessary to fulfill our production requirements and meet customer demands. These delays or product quality issues could have an immediate and material adverse effect on our ability to fulfill orders and could have a negative effect on our operating results. In addition, such delays or issues with product quality could adversely affect our reputation and our relationship with Tier 1 suppliers and OEMs. If GlobalFoundries or any other third-party manufacturers experience financial, operational, manufacturing capacity, or other difficulties, or experience shortages in required components, or if they are otherwise unable or unwilling to continue to manufacture our products in required volumes or at all, our supply may be disrupted, we may be required to seek alternate manufacturers, and we may be required to re-design our products. It would be time-consuming, and costly and impracticable to begin to use new manufacturers and designs, and such changes could cause significant interruptions in supply, have an adverse effect on our ability to meet our scheduled product deliveries, and subsequently lead to the loss of sales. While we take measures to protect our trade secrets, the use of a third-party manufacturer may also risk disclosure of our innovative and proprietary manufacturing methodologies, which could adversely affect our business. In addition, increased component costs could result in lower gross margins. Even where we are able to pass increased component costs along to our customers, there may be a lapse of time before we are able to do so, such that we must absorb the increased cost. If we are unable to buy these components in quantities sufficient to meet our requirements on a timely basis, we will not be able to deliver products to our customers, which may result in such customers using competitive products instead of our products.

16

Our sales and operations in international markets expose us to operational, financial and regulatory risks.

Sales to international customers, i.e., customers located outside of Israel, accounted for almost all of our sales to date. International operations are subject to a number of other risks, including:

| ● | Exchange rate fluctuations; |

| ● | Political and economic instability, international terrorism, and anti-American and anti-Israel sentiment, particularly in emerging markets; | |

| ● | Reaction to any conflicts involving Israel, including its war with Hamas, including any official or unofficial boycotts of Israeli companies; | |

| ● |

The effects of the Russian invasion of Ukraine as it may affect suppliers and customers in Europe;

| |

| ● | Global or regional health crises; |

| ● | Potential for violations of anti-corruption laws and regulations, such as those related to bribery or fraud; |

| ● | Preference for locally branded products, and laws and business practices favoring local competition; |

| ● | Increased difficulty in managing inventory; |

| ● | Less effective protection of intellectual property; |

| ● | Stringent regulation of our products or systems incorporating our products; |

| ● | Difficulties and costs of staffing and managing foreign operations; |

| ● | Import and export laws and the impact of tariffs; and |

| ● | Changes in local tax and customs duty laws or changes in the enforcement, application, or interpretation of such laws. |

The occurrence of any of these risks could negatively affect our international business and, consequently, our business, operating results, and financial condition.

Our business is subject to the risks of earthquakes, fires, floods, and other natural catastrophic events, global pandemics, and interruptions by man-made problems such as network security breaches, computer viruses, or terrorism. Material disruptions of our business or information systems resulting from these events could adversely affect our operating results.

A significant natural disaster, such as an earthquake, fire, flood, or significant power outage, or other similar events, such as infectious disease outbreaks or pandemic events, could have an adverse effect on our business and operating results. Despite the implementation of network security measures, our networks and our products may also be vulnerable to computer viruses, break-ins, and similar disruptions from unauthorized tampering with our solutions, and we have been subject to cybersecurity breaches that were not material and did not result in access to our technical or other confidential information. In addition, natural disasters, acts of terrorism, or war could cause disruptions in our remaining manufacturing operations, our or our customers’ businesses, our suppliers’ businesses, or the economy as a whole. We also rely on information technology systems to communicate among our workforce and with third parties. Any disruption to our communications, whether caused by a natural disaster or by man-made problems such as power disruptions, ransomware attacks, or other cybersecurity breaches, could adversely affect our business. To the extent that any such disruptions result in delays or cancellations of orders or impede our suppliers’ ability to timely deliver product components or the deployment of our products, our business, operating results, and financial condition would be adversely affected.

17

Our business is sensitive to conditions affecting the automotive industry, the duration and economic, governmental, and social impact of which are difficult to predict and may significantly harm our business, prospects, financial condition, and operating results.